The adoption of blockchain technology in financial services is more evident than ever

Since the mid-2020s, the tide has turned in the right direction for cryptocurrencies and underlying blockchain technology. If the latter raised important hopes with Bitcoin And the development of smart contracts on Ethereum In particular, the high volatility in prices and the lack of tangible use cases caused a general sense of caution in the market. Today that is changing with the very big names in the banking and payment sectors with cryptocurrencies and applications that use blockchain technologies.

In fact, although it remains very invisible to the general public who see only the tip of the iceberg, namely Bitcoin, the benefits of using applications that take advantage of the intrinsic properties of the blockchain are numerous. These advantages are the most important to the world of finance as the ability to benefit from the common registry that provides the possibility of full traceability of a group of transactions while maintaining the confidentiality of transaction data is a feature that provides security, transparency and speed in a sector that completely lacks these three characteristics.

A report published by the Venture Capital Company Leadblock Its headquarters in London supports our argument. Actually, that explains that The corporate blockchain application market represents at least 200 startups in Europe that could benefit from around 350 million euros Funding to continue developing in Europe, the most promising continent when it comes to deploying blockchain technology applications in all sectors: Finance of course but also energy, health, agri-food and agriculture.

What use cases are most likely to attract investors by the end of 2021?

So, the question we ask ourselves is the following: Which blockchain technology use cases could attract the most investment in this year 2021?

Asked about it, David Schering MessembourgAnd the author LeadBlock Report He sees 3 main topics that attract the majority of investments from capital projects.

The first is what is called ‘Coding’ This concept makes it possible to place a symbolic representation of an asset in the real world on the blockchain. Thus, coding brings huge potential in the world of finance but also in the real estate world. Converting a building from several million euros into a token to make it more liquid in the market thanks to the blockchain has already been realized. Startup in France Equisafe They even did this to sell an accessory to the Palace of Versailles! One of the key points showing that blockchain technology is now enjoying more maturity is that the sector is starting to roll back use cases with very real experiences already in production.

Wing, Fund management and administration It is a sector where blockchain technology can significantly reduce costs. In fact, thanks to its traceability and data stability characteristics, the technology offers a very interesting alternative to existing processes that are often heavy, sometimes still dependent on paper backs, and thus are very expensive in administration costs. Let’s take again a French example to illustrate this use case. In 2019 The National Gendarmerie Use a blockchain based solution Tesus To simplify and reduce the costs associated with managing the stock exchange from a European fund. Previously, the process of validating the correct use of the fund, which was made on paper, was very cumbersome, and today all is tracked in the blockchain bringing together the actors involved.

Finally and it will definitely be one of the recurring themes of this year, toCentral bank digital currencies or central bank currencies. We’ve actually had the opportunity to research the topic multiple times on Thecointribune. France Bank In addition, many central banks around the world are currently experimenting with the use of the country’s digital currency. This can make it possible to significantly improve the speed of interbank transactions. Additionally, these central bank-linked currencies could end up in the pockets of citizens with a digital wallet. Experiments are already underway on this last point in China. France, leaving until June 2021 before the first assessment.

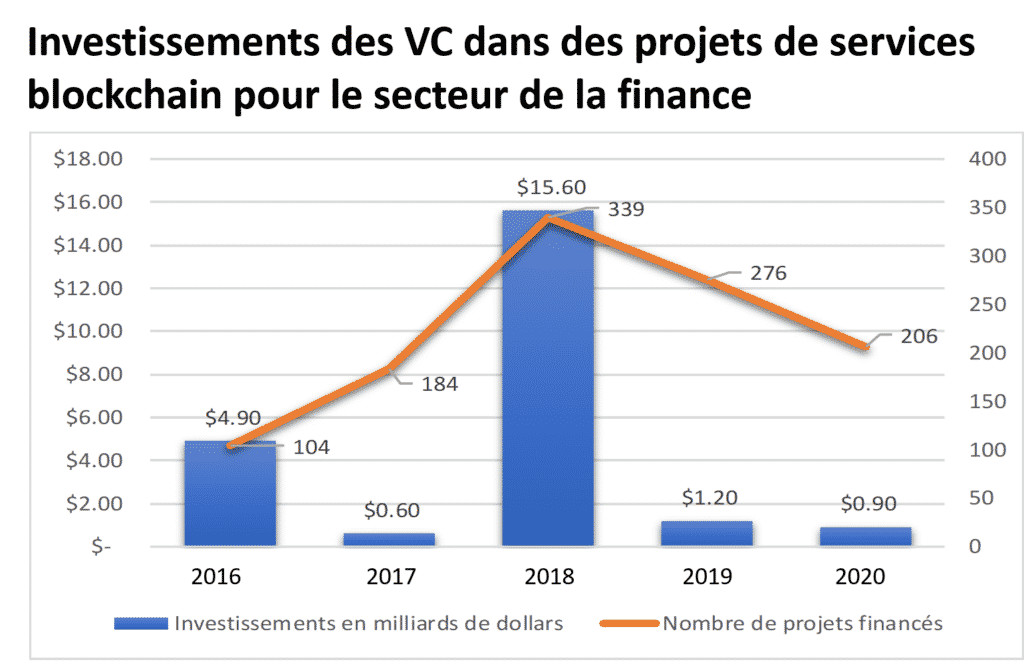

Key figures for blockchain investments in the financial sector since 2016

According to the numbers that he suggested CrunchbaseFrom 2016 to 2020, the financial sector’s investment in blockchain technology applications represents a total of over $ 23 billion.

With an annual average 5.75 billion Investment dollars, which is the average falls to 2.25 billion Dollars if we exclude financingAnts group Of the now famous founder ofAli Baba Jack Ma. Every year that’s 4 years, it’s a little more 270 blockchain projects That were funded to the financial sector.

Despite the important numbers, however Ants group That inflates the curve, yet there is nothing to jump to the roof. Many explanations for this, the “bear market” of the cryptocurrency sector did not help boost blockchain technology during the period, finally in 2020, when cryptocurrencies regained their momentum, the global pandemic stopped it.

However, 2021 shows more encouraging signs of blockchain technology in the financial sector. according to Brooke PollackFounder of the investment fund Hot CapitalMany elements indicate that 2021 will break the monotonous trend of recent years.

« We saw a significant increase in the number of financing operations during the last quarter, and this increase is mainly driven by massive activity around the blockchain companies as well as the cryptocurrency ecosystem. The remarkable performance in the cryptocurrency market is attracting the attention of investors who now want to continue investing in 2021 ».

Decentralized Finance: fertile ground for entrepreneurs to develop new applications

Whereas, the financial sector can thus skip the second and invest in blockchain technology applications to improve its operations, increase the speed of transactions and increase transparency in the markets. There is one sector that is gaining weight, and it is Decentralized financing. Although it is not yet mature, it may represent the greatest potential for growth, in proportions similar to what has been in the crypto market since the advent of Bitcoin.

In 2020, the decentralized financing market has grown from $ 800 million to $ 19 billion. Only that! It could continue in this direction. In fact, DeFi as it is called is to move away from the crypto market to provide more traditional financial services for investment, credit, trading, etc … it all depends on projects including governance and subsidiary technology. Decentralized financing.

Although 2020 allowed many of DeFi’s protocols to appear in the eyes of a wider audience. The applications that make it possible to provide these services to the general public are not many yet and the user experience has not passed the course yet. However, this has been observed during the past Blockchain Week Summit in Paris, We should be raising our hat to this segment which is showing good progress, with some nuggets including makerAnd the complexAnd the artificial or Dharma.

Moreover, the cryptocurrencies are the exchanges Binance And the Crypto.com They understand the potential of this sector, as they are already offering Challenge products on their exchanges. But other apps for the general public may soon appear: enough to attract new investment and keep DeFi growing.

« We are excited to see the arrival of a community of entrepreneurs ready to make decentralized finance accessible to as many people as possible.» Alon Goren, Partner at Draper Goren Holm.

Adopting cryptocurrencies, the end of demonization?

While that Bitcoin and Ethereum reached all-time highs. It is interesting to stress a point that may have contributed to the price spike in recent weeks. This is the investment of large companies in cryptocurrencies.

If we were talking at the beginning of the article about investments in blockchain projects outside of cryptocurrencies, it seems that the barrier between technology and the most important case of its use, that is, cryptocurrency, with Bitcoin at the top of the list. File, or in the process of crashing.

This was formerly diabolical, and represents an investment of the future to secure their cash flow against the dollar that is finding it increasingly difficult to maintain its status as an exchange currency and international store of value. As proof of this, since the beginning of 2021, its price has decreased by more than 10%.

There is no shortage of examples of companies that have invested directly or indirectly in cryptocurrencies. The most obvious example is definitely Little strategy Who has invested in more than 70,000 Bitcoins It is valued at over $ 1 billion today. But there is also Company box Jack Dorsey CEO of Twitter or PayPal That has moved on to encryption times recently.

Therefore, it is a safe bet that 2021 will continue to follow this trend in market adoption by institutional investors, whether through direct or indirect investment. Plus, the Facebook Libra project that I pivoted on The project dim It has to be talked about this year in its stable currency. It is enough to continue to shed light on the cryptocurrency market and thus attract potential investors.

Finally, if some ask about the lack of regulation in the cryptocurrency market, Michael Gronager, CEO of Decomposition He has another view on the question, see rather:

Previously, we needed regulations in the financial markets in order to track banks ’actions. But with the arrival of blockchain technology, the transparency that makes it possible to scale back in terms of regulations in order to facilitate business activities has increased. This is also our only way to compete with other countries like China. ”

As you understand, investments in blockchain technology are no longer secret to the financial sector. Hence, applications that integrate blockchain technologies have a chance to play in 2021 for real added value. There are also strong issues around the challenge, which must be taken a step further by providing services to the general public. Finally, cryptocurrencies continue to attract institutional investors. Several elements that allow an ambitious approach to the year for blockchain and cryptocurrencies.

“Certified tv guru. Reader. Professional writer. Avid introvert. Extreme pop culture buff.”

More Stories

Pitch: €56m for energy startup Reverion

Plastoplan: Plastics for Energy Transition

Canon Launches Arizona 1300 Series with FLXflow Technology