- Former vice chairman Gerald Storch thinks the company’s ‘bend-friendly’ swimwear sets Target’s Pride collection apart for the worse

- Other businesses carry colorful dishes and gingerbread houses, he said, and that’s “good” because “who cares? Everyone carries that stuff.”

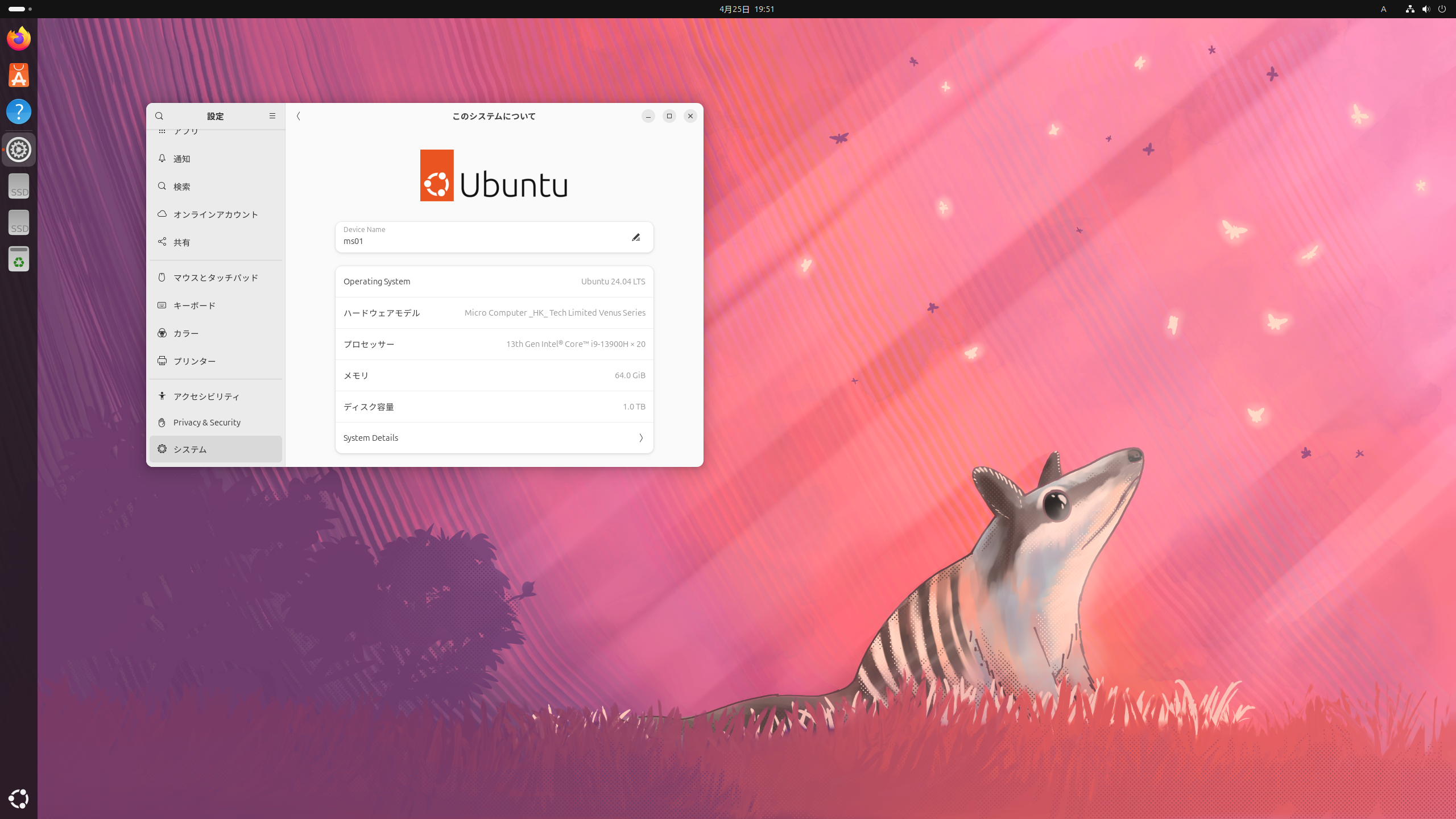

- Target suffered another financial setback after JPMorgan downgraded its stock as its market value fell by $12 billion.

The former Target CEO said the retailer’s biggest mistake was selling “fold-friendly” swimwear to Pride, which has resulted in a $12 billion loss since mid-May.

Gerald Storch, former Vice Chairman of Target, believes the company’s controversial “tuck-friendly” swimwear sets Target’s Pride collection apart from others for the worse.

I’ve never seen a case where one item, a pleated swimsuit, really made the difference from the competition. This is where the big mistake is [was] Made, he said Fox and friends.

Other companies carry colorful dishes and gingerbread houses, he said, and that’s “good” because “who cares? Everyone carries that stuff.”

Target suffered another financial setback after JPMorgan downgraded its stock as its market value fell by $12 billion, amid backlash for the release of controversial LGBTQ Pride product.

Sure enough, Target stock has underperformed 11 percent year-to-date. So that’s not good, and sure, this interruption to the whole issue here doesn’t help. It’s very distracting to have this happen at work. But there are more fundamental concerns about that, with the environment, consumer and business here,” Storch said.

Shares of the brand fell for the ninth straight day on Wednesday, dropping another 2.14 percent as the company is in the midst of its longest equity losing streak in 23 years.

Prior to the controversy, the company had a market capitalization of $74 billion, with shares trading at $160.96 at the markets close on May 17.

And despite the brand’s efforts to undo its disastrous campaign, the continued decline in shares led JPMorgan to downgrade its stock rating from “neutral” to “overweight” on Thursday, citing “concerns too high.”

We continue to believe consumer weakening broadly while portfolio share is shifting away from commodities (51% of [Target’s] wrote analyst Christopher Horvers at JPMorgan, according to MarketWatch.

Horvers also cited “recent company controversies” as the reason Target posted devastating financial losses, which came after an “impressive streak of 12 consecutive positive quarters.”

As customers rebelled against the move, the brand made “adjustments” to its promotion plans, including removing displays “that were at the center of most confrontational behavior” in some of its stores, CEO Brian Cornell said in a recent statement. week.

Some Southern stores have been forced to move merchandise—much of which was designed by Eric Carnell, a self-proclaimed Satanist and transgender man—to the back of the stores.

In addition, Storch, who now owns his own company, said the company’s decline began on May 18 when competitor Walmart reported a “7 percent increase in corporate sales.”

Target reported flat sales, flat for the year at Target, up seven at Walmart. There is no way this comparison looks good.

While there’s no doubt that the boycott is part of the problem, if you read the reports about Target during this period and analysts keep in mind what investors are, who are buying things about the stock or perhaps in this case selling picks the amount of shares. They are more interested in basic business issues.

“You know, they are.” [Target] He definitely didn’t handle this well, either getting in or trying to deal with him on the way. But I think that over time, this will not be such a big problem for them.

“Extreme travel lover. Bacon fanatic. Troublemaker. Introvert. Passionate music fanatic.”

More Stories

A Delta Air Lines Boeing plane lost an emergency midair skid after takeoff from JFK Airport

Exxon Mobil and Chevron announce a decrease in their profits

The Bank of Japan keeps its monetary policy unchanged