ChatGPT recently celebrated its first anniversary. Intelligent chatbots can personalize banking services and make them more efficient. Nine challenges and possible solutions are important and should be taken into consideration.

Chatbots with generative AI provide more services to bank customers.

Banking is facing a transformation in which artificial intelligence (AI) and machine learning (ML) play a central role. AI can be divided into different areas including machine learning, natural language processing (NLP), robotics, and computer vision. Of particular note are the generative AI models that enable hyper-personalization of the customer experience. Chatbots like ChatGPT are considered the “iPhone moment for AI” because they are fundamentally changing how we interact with technology.

Chatbots in Banking: Why?

Chatbots are revolutionizing banking with a variety of benefits: they improve customer support, enable end-to-end banking for even the least tech-savvy customers, and shape the future of communications. A key aspect is customer enthusiasm with new technologies and the ability to efficiently address complex customer concerns 24/7.

9 Challenges and Solutions for Chatbots in Banking

However, implementing chatbots in banking is not without challenges. Below are the most important characteristics that a chatbot must have in order to be usable in real operation.

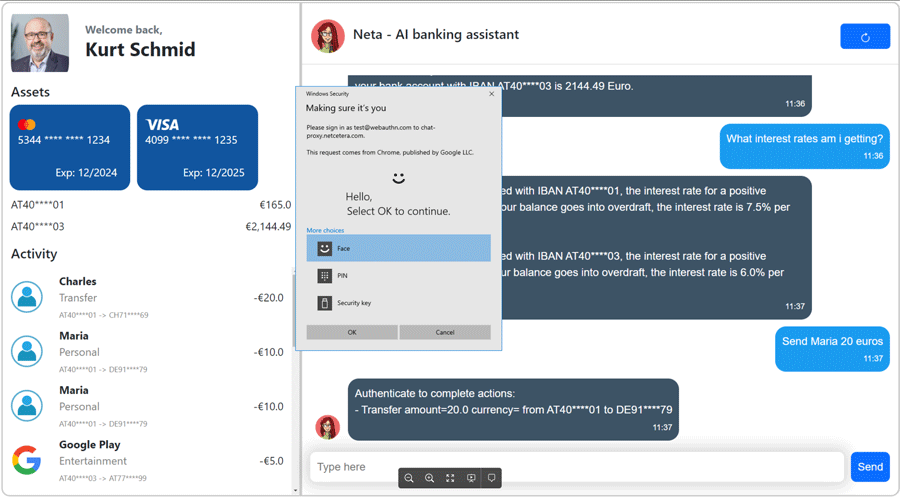

- Interacting with user data: A chatbot must be able to not only read and access user data such as account transactions, but also make changes such as transferring funds or blocking a card. Additionally, the chatbot must recognize when user authentication is required and initiate it in order to meet PSD2 requirements.

- Up-to-date data and prices: The chatbot must know current data and prices and be able to calculate using them.

- Accurate and clear answers: Your chatbot should provide accurate answers without lecturing or using unnecessary disclaimers.

- Knowing the history of the conversation: A chatbot needs to know the history of the conversation in order to provide coherent and contextual answers.

- Compliance and correct statements: The chatbot may not make any statements that are not in the interest of or outside the scope of the bank’s compliance.

- Data Protection: Personal data such as names, IBANs and PANs may not be disclosed. A “privacy layer” is required that encrypts confidential data and thus protects user privacy. Alternatively, large language models (LLMs) can also be run on private servers.

- Understanding slang: Your chatbot should also be able to understand slang expressions or “slang.”

- Tolerance to typos: A chatbot must be tolerant to typos in order to be able to communicate effectively with users.

- Multilingual: The chatbot must be able to speak the languages of different users.

The technology behind it

We all know that ChatGPT is a generic way to create claims and get answers. However, with banking chatbots, a communication such as “Did you pay my electricity bill” needs access to the user’s transaction data. Technically, this works via “function calls”, which are called by the LLM system before the response is generated. The transaction line with the reference “Wien Energie” is then recognized as the electricity provider because semantic proximity is taken into account here.

The process becomes more complicated if actions are allowed to be performed only after user authentication. Then the chatbot must also be able to change the status of cards or send transactions to the banking system.

IQChat4Banks for a new level of communication with customers

A bank customer asks: “I can't find my credit card anymore,” and the chatbot immediately responds with targeted questions to clearly identify the missing card among the three existing ones and offers to block it temporarily or order a replacement card. This is what the future of banking could look like with 'IQChat4Banks'.

An experimental chatbot could revolutionize the way we do banking. One year after its launch, ChatGPT enables a new level of communication with customers, made possible by OpenAI's advanced macrolanguage model.

When the “Send Maria 20 Euros” transfer is initiated, the chatbot recognizes that client authentication is required. In the example here, FIDO authentication is required via Windows Hello facial recognition.

The future: plans and other considerations

Future developments could include creating user profiles for different age groups and communication styles to enable greater inclusion as well as providing the cool factor for Generations Z and Alpha.

In addition to banking bots as a complement to mobile and web banking, onboarding bots, chargeback handling bots, or financial advisory bots could also provide more potential uses for AI in banking.

Integrating AI and chatbots into banking is a promising step towards a more efficient, personalized and inclusive financial world. While challenges such as data protection and ease of use remain, technology offers tremendous opportunities to improve the customer experience and increase the efficiency of banking services.

Note: A draft of the article was created using ChatGPT from a PowerPoint presentation and enhanced as an editor, but in all important respects was created by the author himself. Still.

“Certified tv guru. Reader. Professional writer. Avid introvert. Extreme pop culture buff.”

More Stories

Samsung Quantum Dot TV: Art meets technology

Pitch: €56m for energy startup Reverion

Plastoplan: Plastics for Energy Transition