Stocks wobbled Friday in a choppy trading session after a much better-than-expected July jobs report as investors assessed what a strong labor market will mean for the Federal Reserve’s rate-tightening campaign.

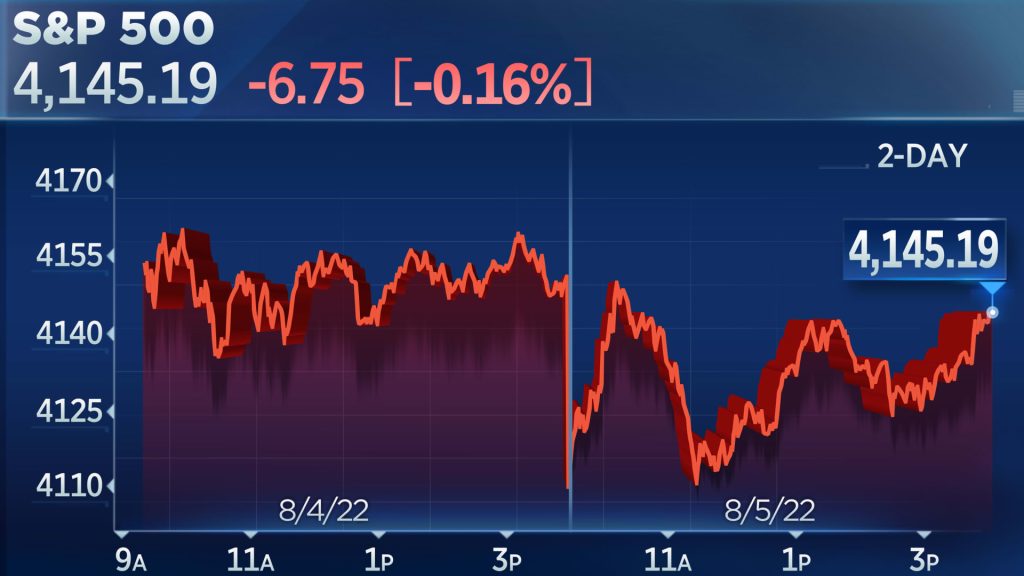

The Dow Jones Industrial Average rose 76.65 points, or 0.23%, to close at 3,2803.47. Even with Friday’s gains, it has fallen during the week. The S&P 500 fell 0.16% to close at 4,145.19, and the Nasdaq Composite lost 0.50% on Friday, falling to 12,657.56. However, the S&P 500 and Nasdaq both ended the first week of August higher.

The losses were offset by banking stocks, which rose on the hope that interest rates would continue to be raised at strong rates. Energy stocks also rose, but tech companies fell.

The labor market added 528,000 jobs in July, Easily Beating the Dow Jones rating An increase of 258,000. The unemployment rate fell to 3.5%, down from an estimate of 3.6%. Wage growth also rose more than expected, up 0.5% for the month and 5.2% higher than last year, indicating that high inflation remains likely an issue.

Stores I opened less after the report, even if it seems to indicate that the economy is not currently in a recession. Job growth was expected to slow as the Fed continues to raise interest rates to tame inflation, but this report shows that the labor market remains brisk. This means that the central bank may act more forcefully at its next meeting.

Art Hogan, chief market strategist at BP, said: Financial issues. “It’s clearly a situation where the economy is not screaming or heading into a recession here and now.”

Friday’s jobs report is an important one because it is one of two the central bank will watch before it decides how much to raise interest rates at its September meeting. In fact, traders are already betting on a Tougher stance from the Federal Reserve. Policy makers will have another jobs report and two more Consumer Price Index Numbers that need to be evaluated before the central bank makes its next interest rate decision.

The major averages posted their best month since 2020 in July on hopes that the Fed will slow the pace of its increases. The S&P 500 added 9.1% last month.

“Extreme travel lover. Bacon fanatic. Troublemaker. Introvert. Passionate music fanatic.”

More Stories

Jet collision narrowly avoided at Ronald Reagan Washington National Airport

Stocks look to rebound with Netflix earnings

TSMC's Q1 2024 earnings thanks to strong demand for AI chips