Electric car maker Tesla (TSLA) will be the first of the “Magnificent Seven” stocks to report earnings this season. The company is scheduled to announce third-quarter 2025 results on October 22. Tesla stock has made a strong comeback after a difficult start to the year. Over the past six months, shares have risen more than 100%, fueled by growing optimism around AI ambitions and strong vehicle delivery numbers. In the third quarter, Tesla delivered 497,099 vehicles, well above analysts’ estimates of 439,800, boosting investor confidence.

Level up your investment strategy:

- Take advantage of TipRanks Premium at 50% off! Unleash powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, there are still challenges ahead. Increased competition in the electric vehicle market and questions about how Tesla will leverage its AI efforts continue to weigh on sentiment. While Tesla’s long-term story remains focused on artificial intelligence and automation, the absence of meaningful revenue from these areas is leading to growing investor skepticism. As a result, Wall Street remains cautious ahead of Tesla’s earnings report.

What to watch on October 22

Wall Street expects Tesla to report earnings of $0.55 per share in the third quarter, down 24% from the same quarter last year. Meanwhile, analysts expect third-quarter revenue to reach $26.33 billion, up 5% year over year.

Tesla’s earnings call will be closely watched for updates on profit margins, production costs and how the company is managing pricing pressures amid increased competition. Investors will also be looking for feedback on vehicle delivery trends, progress on new models, and updates on energy storage and autonomous driving initiatives.

Analyst opinion ahead of third quarter print

Ahead of the third-quarter results, BNP Paribas analyst James Picariello initiated coverage on Tesla with a sell rating and a price target of $307, suggesting a potential 30% downside from current levels. Picariello argued that Tesla’s trillion-dollar valuation is largely driven by optimism surrounding artificial intelligence projects — such as robotaxis and human-like robots — that don’t yet contribute any revenue.

“We see the potential for positive development in AI over time, but it seems like a lot of that has already been calculated,” he said.

Can Tesla shares be bought now?

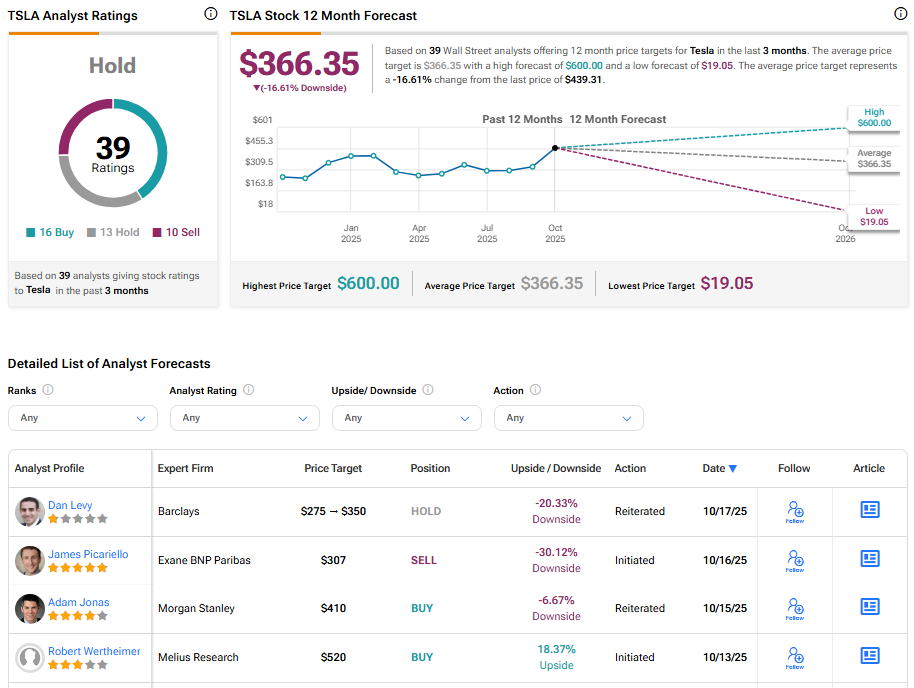

On Wall Street, analysts maintained their firm stance on Tesla shares. According to TipRanks, TSLA stock has a consensus rating of Hold, with 16 Buys, 13 Holds, and 10 Sells in the past three months. The average price target for Tesla stock is $366.35, which indicates a potential downside of 16.6% from the current level.

See more TSLA analyst reviews

Disclaimer and Disclosure Report a problem

“Extreme travel lover. Bacon fanatic. Troublemaker. Introvert. Passionate music fanatic.”

More Stories

Best National Burger Day Deals 2024

Trump attacks Fed for ‘playing politics’ with historic rate cut

Thousands of people in Europe, including Ireland, Switzerland, Germany, the United Kingdom and Denmark, are facing travel chaos with 238 of the cancellation affects