NEW YORK/LONDON (Reuters) – Stocks fell worldwide on Tuesday as the supply chain hit corporate profits, soaring costs and slowing industrial production, while Treasury yields slumped as weaker stocks revived a bid for a safe haven on US government debt. .

Business activity in the US and the eurozone slowed in May, as S&P Global attributed the decline in its US PMI composite output to “rising inflationary pressures, additional deterioration in supplier delivery times and weak demand growth”.

Higher costs from higher freight and raw material prices led to Abercrombie & Fitch (ANF.N) To say it will continue to face headwinds until at least the end of the year, a day after Snapchat, Snap Inc (SNAP.N) He said the US economy worsened faster than expected in April. Read more

Register now to get free unlimited access to Reuters.com

A two-day rebound in stocks was wiped out as investors noted slumping corporate profits due to ongoing supply chain issues, exacerbated by the Ukraine war, and high inflation that has forced consumers to cut discretionary spending.

The US economy is likely to face a sharp slowdown as the Federal Reserve raises interest rates to stem inflation, according to David Petrozinelli, senior trader at InspereX.

“It’s really all about a hard landing and the Fed is really stuck in a corner with demand-side tools just to help,” Petrocinelli said. “They really need to crush the demand.

“This will have a ripple effect on the economy, which is why you see price action in stocks and bonds,” he said.

MSCI’s benchmark for stocks worldwide (.MIWD00000PUS) The pan-European Stoxx 600 index fell 1.69%. (.stoxx) He lost 0.99%.

On Wall Street, the Dow Jones Industrial Average (.DJI) The Nasdaq Composite Index is down 1.37%. (nineteenth) The S&P 500 fell 3.33% (.SPX) It lost 2.16% as it headed back towards a bear market.

Snap shares fell 41.1%, sending many social media and internet stocks down, while Abercrombie stock fell 29%.

In Europe, the facilities (.SX6P) Commodity-related stocks (.SXPP)And (.sxep) The declines led, but banking shares rose.

European Central Bank President Christine Lagarde said she saw the ECB’s deposit rate at zero or “a little bit higher” by the end of September, meaning an increase of at least 50 basis points from its current level.

The comments came a day after Lagarde accelerated a policy shift that has seen her go from everything but ruling out a move this year to starting with several hikes.

“This has raised nervousness in global markets about the possibility that the European Central Bank will at least take a more aggressive move,” said Phil Shaw, chief economist at Investec in London.

“There were reports overnight that some hawks in the Governing Council believed her comments yesterday ruled out a 50 basis point increase, but her comments today seem to have left that on the table,” he said.

The yield on German 10-year bonds fell 7.3 basis points to 0.951%.

Treasury yields fell to their lowest levels in one month as the benchmark 10-year Treasury yields fell by 13 basis points to 2.729%.

The dollar index fell 0.343 percent, with the euro rising 0.38 percent to $1.073.

Biban Ray, head of FX strategy at CIBC Capital Markets, said Lagarde’s comments in a blog post on Monday, and swings that have pushed the US currency to two-decade highs, have reinforced the dollar’s tactical weakness.

“The broader macroeconomic background continues to support risk taking,” Ray said. “The dollar still has more room to beat in the medium term.”

frustrating data

Markets took some relief from US President Joe Biden’s comment on Monday that he was considering easing tariffs on China, and from Beijing’s continued promises of stimulus. Read more

Unfortunately, China’s non-proliferation policy and the lockdowns it has already imposed have caused significant economic damage.

JPMorgan cut its forecast for China’s Q2 GDP to -5.4% from -1.5% previously after disappointing data in April. On an annualized basis, its global outlook for the quarter is 0.6%, the weakest since the major financial crisis outside of 2020.

US crude oil recently fell 0.05% to $110.23 a barrel, and Brent crude was $113.76, up 0.3% on the day.

Spot gold rose 0.8% to $1,867.57 an ounce.

Register now to get free unlimited access to Reuters.com

(Additional reporting by Herbert Lash in New York and Lawrence White in London.) Reporting by Wayne Cole in Sydney; Editing by Simon Cameron Moore and Jonathan Otis

Our criteria: Thomson Reuters Trust Principles.

“Extreme travel lover. Bacon fanatic. Troublemaker. Introvert. Passionate music fanatic.”

More Stories

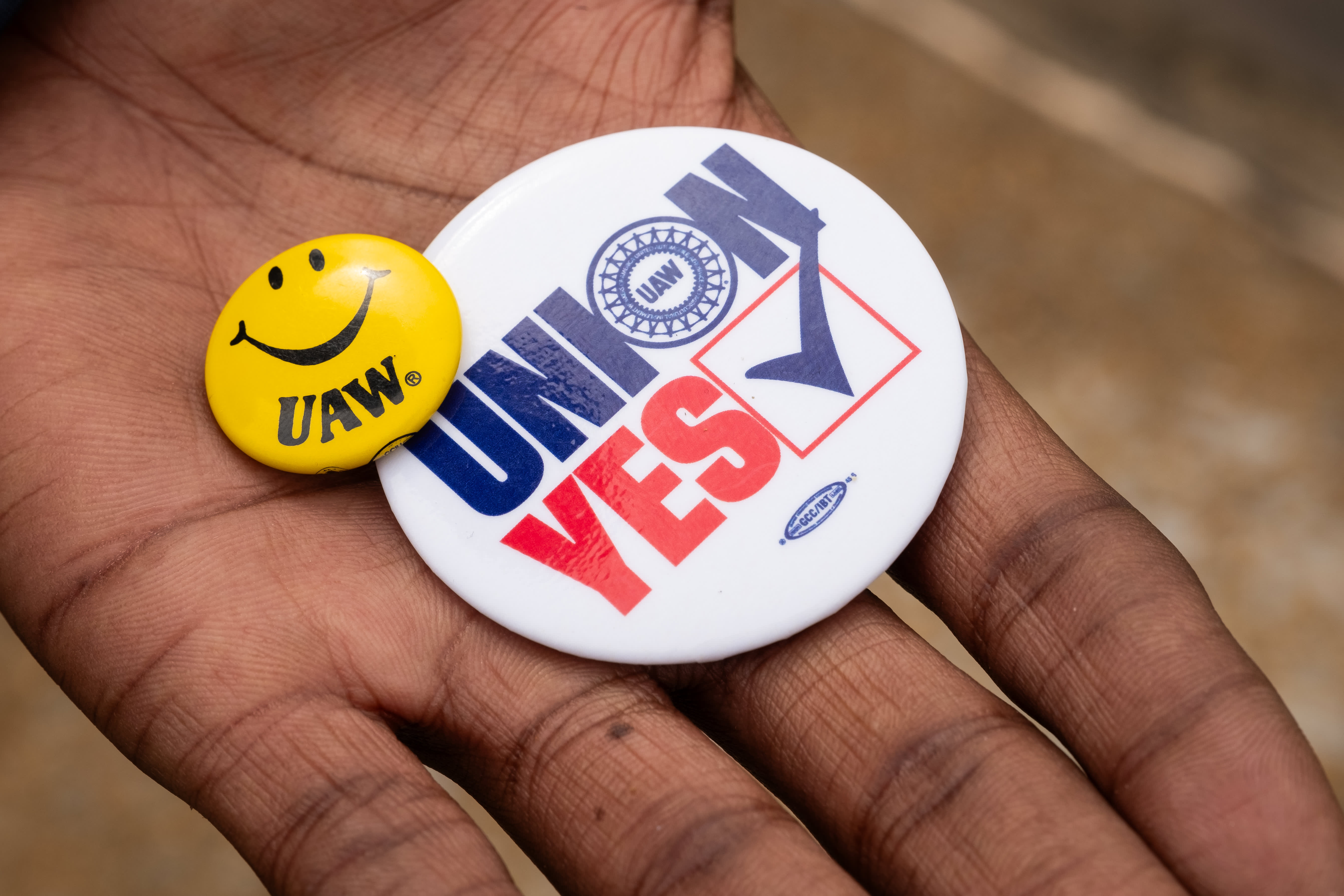

Volkswagen workers in Tennessee vote to join the UAW in a historic win for the union

Tesla is recalling nearly 4,000 Cybertrucks for the 2024 model year

Procter & Gamble raises annual profit forecasts thanks to strong consumer demand in the United States, which eases costs