Open Editor’s Digest for free

Rula Khalaf, editor of the Financial Times, picks her favorite stories in this weekly newsletter.

Stocks and government bonds rose on Thursday as European central banks moved away from the United States, defying market expectations of deep interest rate cuts early next year.

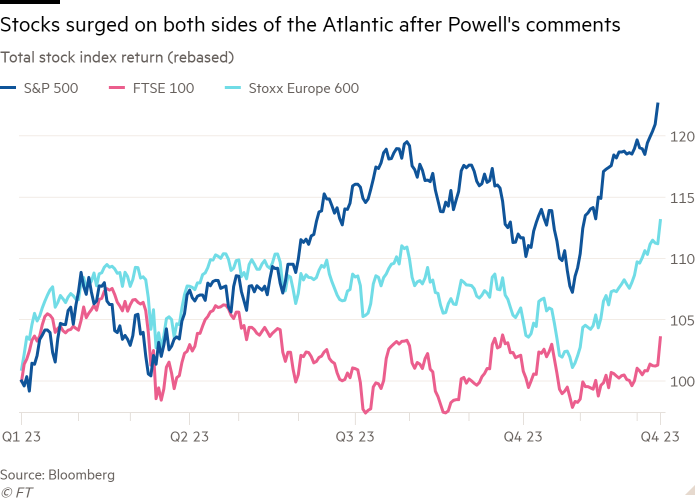

In New York, the Standard & Poor’s 500 index rose by 0.4 percent and the Nasdaq index rose by 0.4 percent, leading to a rise in the global stock market. Treasury yields fell sharply as new forecasts from Federal Reserve officials pointed to cuts of 0.75 percentage point next year, much more than investors expected. Bond yields move inversely with prices.

“It’s a bumper early Christmas present” from the Fed, said Charles Hepworth, chief investment officer at GAM Investments.

But European stocks pared their gains after the Bank of England and the European Central Bank rejected growing market expectations that they were ready to cut interest rates.

Bank of England Governor Andrew Bailey said there was “still a long way to go” before inflation reached its target, while his European Central Bank counterpart Christine Lagarde said there was “work to do” to tame inflation and “we must not lower our guard at all.” Against consumers. Price pressures.

However, traders have been betting on European interest rates after a US decline in 2024. Swaps markets still expect around six 0.25 percentage point rate cuts each from the Fed and the European Central Bank next year, and at least four from the ECB. England.

The European STOXX 600 rose 0.5 percent, while the FTSE 100 rose 1 percent in London. In bond markets, the yield on interest rate-sensitive two-year Treasuries fell by 0.1 percentage point to 4.38 percent, while the yield on two-year German Treasuries, the euro zone benchmark, fell by 0.09 percentage point to 2.56 percent.

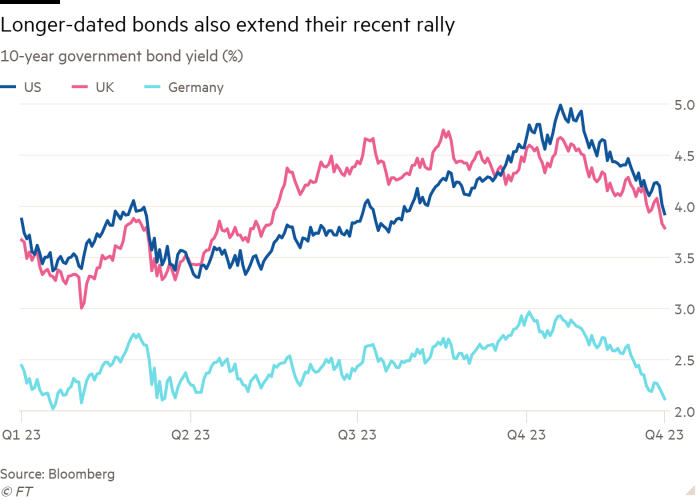

Ten-year Bund yields fell 0.03 percentage points to 2.14 percent, the lowest level since March, while 10-year government bond yields fell 0.06 percentage points to 3.77 percent.

“Despite the BoE and ECB trying to back away from early interest rate cut expectations, Powell’s comments consequently dominated Lagarde and Bailey,” said Mark Dowding, chief investment officer at RBC BlueBay Fixed Income.

The dollar fell 0.9 percent against a basket of its counterparts, while gold added 0.5 percent to $2,037 per ounce.

Investors drew confidence from the Fed’s forecast and Fed Chair Jay Powell’s comments that the central bank “is likely to be at or near its peak during this tightening cycle.”

Seema Shah, chief global strategist at Principal Asset Management, said the Fed had made a “major turnaround.” . . From emphasizing a longer-term rally, to now focusing on a shorter-term rally.

Market expectations for interest rate cuts have shifted sharply in recent weeks after weaker-than-expected inflation and economic data increased conviction that central banks have now tightened monetary policy enough to return inflation to their 2 percent targets. Markets were expecting the Fed to back off the number of cuts planned for next year.

Instead, “quite the opposite happened,” said Richard McGuire, head of interest rate strategy at Rabobank. “It’s no surprise that stocks are ‘loving life,'” he said. “The Fed’s surprise to the market yesterday should certainly be a watershed moment” for bond investors, he said.

The pound sterling rose 0.8 percent to $1.2720 after the Bank of England said inflation “has a long way to go” until it reaches its target, while risks surrounding its inflation forecast remain “skewed to the upside.”

“While the Fed has begun discussing the possibility of cutting interest rates, the Bank of England’s choice is still only between holding or raising interest rates,” said Matthew Landon, global market strategist at JP Morgan Private Bank.

“Markets are starting to smell a global pivot by central banks after the Fed turned dovish last night. The Bank of England hasn’t quite followed suit.

“Extreme travel lover. Bacon fanatic. Troublemaker. Introvert. Passionate music fanatic.”

More Stories

Dow Jones rises 650 points as stock market rebounds

Boar's Head Deli Products Recalled Amid Listeria Outbreak Investigation

5 Things to Know Before the Stock Market Opens on Wednesday, July 24