- INJ stakeholders lost out on significant gains made during the September rally.

- Now, hope of a breakthrough depends on a key factor.

Injection [INJ] The coin defied September's downtrend, rising more than 40% to $23 last week. However, a price correction in October erased much of those gains, bringing INJ back to its previous levels.

Recently, network injection Announce Milestones, resulting in a significant increase in user base and a 6% increase in INJ value.

Despite this short rally, the rally was cut short due to a bearish MACD crossover on the daily chart. AMBCrypto then investigated whether this bounce could trigger a breakout, as has been the case with many… Analysts expected.

INJ is in short supply

Injective's innovative burn auction, introduced with INJ 2.0 in 2023, has simplified the token burning process.

For context, it enables individual users to contribute directly to the auction fund; INJ Network has made it easier to burn tokens.

Recently, the network Announce Burning an additional 200,000 INJ tokens, a move that is expected to positively impact INJ price movement in the long term.

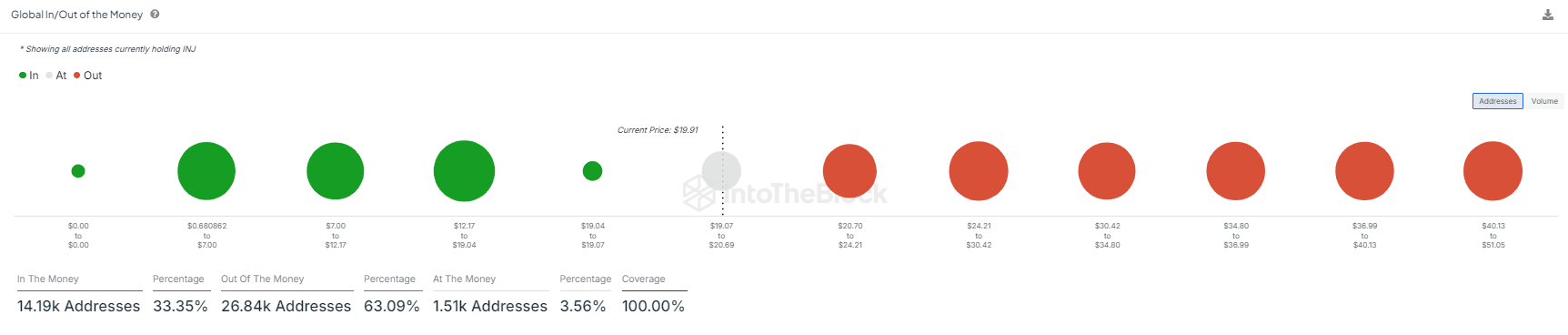

However, as AMBCrypto noted, the recent price pullback has pushed many INJ holders into a loss-making position. A large portion of these investors represent 1.66 million INJ, acquired at an average price of $22, which is below the current trading price.

Source: IntoTheBlock

If other holders see the current price as the bottom of the market and decide to buy the dip, these investors may have an incentive to stop breaking even, in addition to the previously mentioned network achievements.

If this trend continues, the next big test for Injective will be to turn the previous resistance of $23 into support, and if they succeed, the next resistance could reach around $30.

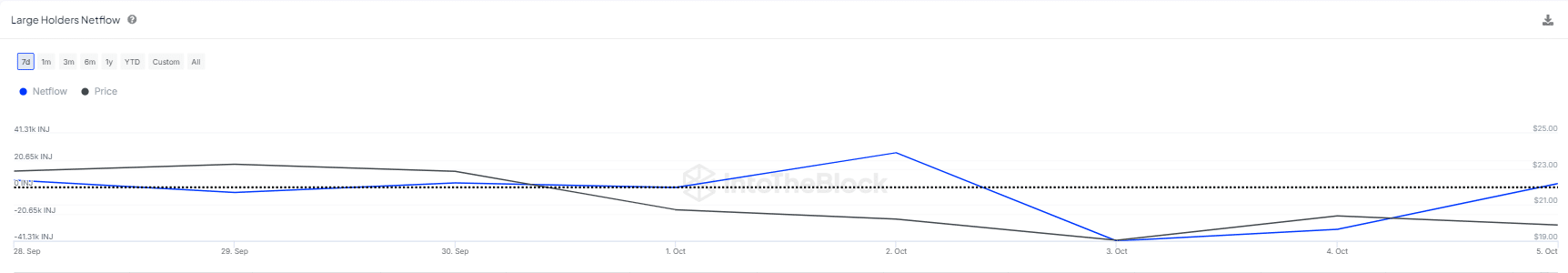

Whales support this idea

This week, large groups of whales intervened to prevent INJ from making a deeper pullback that could have seen the price drop to $18. Their efforts resulted in a remarkable 7% gain, pushing INJ back up to $20.

The chart below shows that approximately 45 thousand INJ tokens flowed from exchanges into whale wallets, accumulated during the decline and successfully flipped the $18 level to the support level.

Source: IntoTheBlock

While this is a bullish signal, declining whale holdings could pose a challenge to the bulls trying to hold the $23 level.

In short, this accumulation signals a potential market bottom, encouraging loss-holders to maintain their holdings while attracting profit-holders through FOMO, which is crucial to creating the $23 support.

Injection reading [INJ] Price forecasts 2024-2025

However, if whales pull back, major players may lose confidence in the recovery, which could push INJ back to $18.

Therefore, tracking whale activity is essential to achieving a breakthrough. If whales remain committed in the long term, their confidence could help bulls hold on to the $23 support level, paving the way for the next resistance level at $30.

“Extreme travel lover. Bacon fanatic. Troublemaker. Introvert. Passionate music fanatic.”

More Stories

Tesla's 'We, Robot' event will likely include Robotaxi, $25K EV and Optimus updates, Munster says: Will Elon Musk pull off a surprise with this product announcement? – Tesla (NASDAQ: TSLA)

What's wrong with the chicken tenders provided by a KFC customer?

Video shows a fire coming from a Frontier flight after landing in Las Vegas