Exclusive: A decade after the recent overhaul of California's film and television tax credit program, Gov. Gavin Newsom today will unveil a massive increase in incentives for startups and productions in the home of Hollywood.

In an announcement this afternoon at the Raleigh studios, the governor will reveal that he aims to boost the state's tax breaks from their current level of $330 million annually to about $750 million annually, I've learned.

The whooping increase won't happen immediately, and is subject to approval by the Democratic-majority Legislature in the Golden State's 2025-2026 budget. However, in this election year with close races, Sunday's announcement aims to increase confidence locally in the industry and workforce that has seen production in Los Angeles and across the state shrink dramatically and jobs dry up over the past year or so, sources said. He says.

To that end, Governor Newsom will be joined at today's press conference by Los Angeles Mayor Karen Bass and a Praetorian guard of labor leaders, below-the-line workers, state officials and industry consultants. Mayor Bass has been a vocal proponent of increasing state tax credits to offset the “slowdown,” as the mayor told Deadline in August, of production in the city. With Los Angeles production down by double digits in 2023, Bass also floated the idea of a local tax credit.

Regardless of whether this idea ever becomes a reality, it was clear even before last year's labor unrest that something needed to change in the state's tax credit program.

“The program is oversubscribed and outdated,” exclaimed one insider of California's current Big and Small Screen program, which offers 20-25% tax breaks for studio/streaming films, independent films, new TV series and transmitted shows. “A lot of productions don't apply because there's little chance they'll work. The industry, crews, and content delivery methods have changed dramatically over the past 10 years, so what the state offers doesn't meet basic needs, and barely competes with Atlanta or Canada.”

Besides the bottom line increase, I'm told today's increase announcement by Gov. Newsom will change nothing else regarding the program administered by the California Film Commission. No new categories, no new ratios, nothing.

In fact, leaving everything as is besides the money, the expectation from Sacramento, studio, broadcast, union and civic allies is that the revitalized program will be viewed as more accessible than ever by potential applicants who want tax breaks and the ability to Plan ahead with projects. The term-limited Newsom will likely have great difficulty passing the increase as part of next year's budget deal. Politicians had to cut many progressive programs this year to reduce the state's estimated $46.8 billion deficit, but movie and TV tax breaks were left untouched.

That's partly because the program has proven to be a source of income for the state in the big picture.

Even as the media industry began to slow, a 2022 report from the Los Angeles Economic Development Corporation asserted that “for every dollar allocated to the tax credit, the state benefited at least $24.40 in economic output, $16.14 in gross domestic product, And $8.60 in wages.” and $1.07 in state and local tax revenue.

These are the kind of numbers you can expect Governor Newsom to put out later today.

Also, coupled with a doubling of California's credits, which were created in their current form in 2014, this increase would make the Golden State the top source of excise tax incentives in the country — at least on paper. Right now, with a $280 million expansion last year, New York State is offering about $700 million in specific incentives. However, this number is increased by a mixture of indemnities and other exemptions available to productions in the various jurisdictions identified in the Empire State.

While states like New Jersey, Nevada and Utah are putting more tax credit money on the table, Louisiana and Georgia are still among California's biggest competitors. After production shutdowns during the 2023 WGA and SAG-AFTRA strikes and industry-wide layoffs and cost-cutting measures, the Peach State, like California, has not fully rebounded. However, while California has larger productions than anywhere else overall, Georgia, and especially Atlanta, still attracts more big-budget productions on average than anywhere else in the USA.

It doesn't hurt that costs in Georgia are typically much lower than on the West Coast, and that the state has an unlimited incentive program ranging from about $900 million to $1.2 billion annually. Movies or TV shows filmed in the southern state receive a 20% transferable basic tax credit. As the accounting executives at Disney, Netflix, and everyone else in town will tell you without the slightest bit of disbelief, productions also easily get a 10% Georgia entertainment promotion “bump” if they include the state's logo in their credits for five seconds or , according to the Georgia Department of Economic Development, “alternative marketing promotion.”

This new increase recommended by Gov. Newsom on Sunday is sure to change the tax credit status quo.

Part of that involves the risk that other states, Canadian provinces and ever-more-competitive European countries will now increase their offerings, too. The flip side, as has almost happened in Georgia on more than one occasion, is that some states can lower their caps and incentives to avoid busting the budget to remain competitive. It's certainly hard to see New York raising its tally of best California after doing so just a year ago.

Previously a measly $100 million lottery effort, California's program was overhauled and signed into law by Jerry Brown's re-election in 2014. By highlighting job creation, the program also put a premium on struggling TV shows from the likes of Vancouver and New York and Atlanta, as well as finally allowing big-budget films to be eligible to apply. After emerging from the ghost town, the pandemic reached Los Angeles, Governor Newsom and the Legislature boosted the incentive program in 2021 to $420 million for two years and added more appropriations to build more sound stages.

Against that backdrop and with little new production to fill those new audio plays, the latest renewal of the state film and tax credit, SB 132, passed the Legislature overwhelmingly last year. The renewal extended the so-called 4.0 program for another five years starting in 2025, with $330 million in annual refundable incentives now set aside to cover tax liabilities. However, even with the long-term peace of mind, things have become bleaker for Hollywood and uncertainty continues to loom over the 700,000 jobs, according to the state, that benefit from the industry.

One of the major complaints that television productions in particular have had about the amount of money available for small screen projects is that more and more of it isn't actually available. This is because the vast majority of previous successful applicants are carried over year after year as long as they remain on air or online, leading to submission periods when only a few new shows receive any credits.

Looking at the program books, there is $132 million available to applicants for new TV series, mini-series, recurring and pilots in the Motion Picture and TV Tax Incentive Cookie Jar each year, with another $56.1 million for moving TV series. On the film side, distribution averages $115.5 million per year for feature films, plus $10.56 million for independent films with budgets over $10 million and $15.84 million for independent films with budgets under $10 million.

With this, and with the current film and TV tax credit program doubling, the last application period for TV categories closed on October 23, with an approval date of November 25. On the film front, the next application round will take place from January 25 to 27, 2025, with successful applicants scheduled to be notified on March 3, 2025.

“Wannabe web expert. Twitter fanatic. Writer. Passionate coffee enthusiast. Freelance reader.”

More Stories

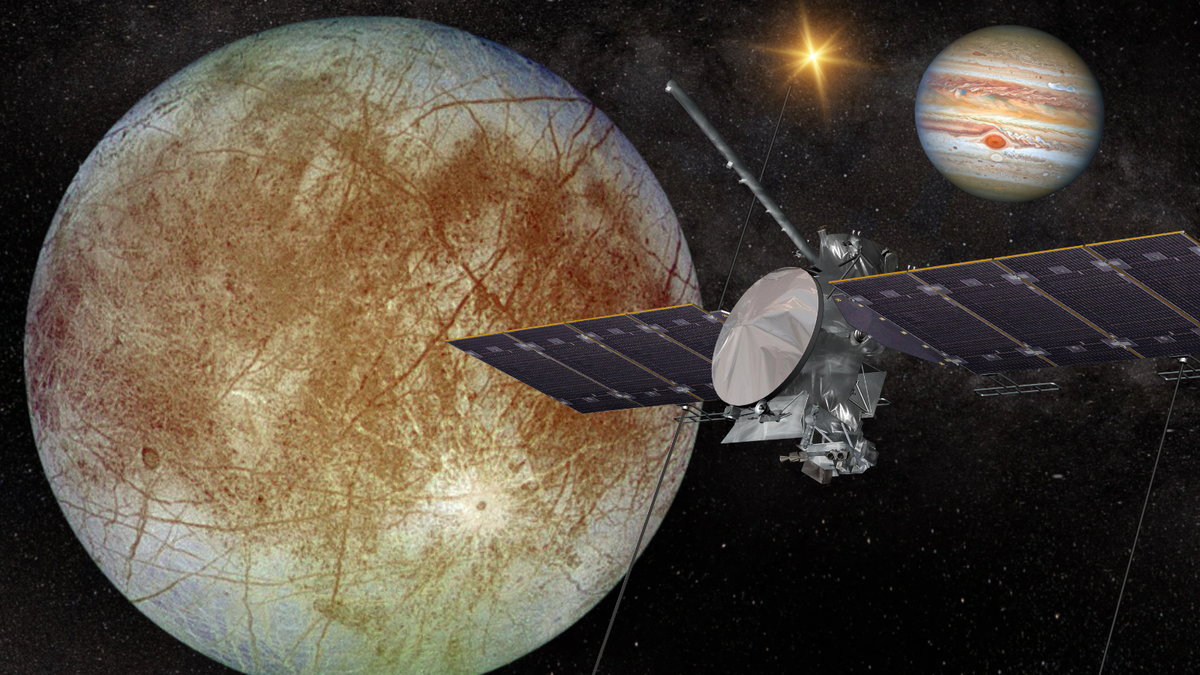

What's next for NASA's Europe Clipper? The long road to Jupiter and its moons

Your future horoscope: October 27, 2024

SpaceX has launched 22 Starlink internet satellites from Florida