Regulators are trying to catch up with the booming “buy now, pay later” movement.

Providers of increasingly popular point-of-sale loans must now offer some of the same protections afforded to credit card users, including the right to dispute charges and seek refunds for returned purchases, the Consumer Financial Protection Bureau announced Wednesday.

The White House praised the move, calling it part of a “broad campaign against corporate fraud.”

“The Biden-Harris administration will continue to take action to protect consumers and keep more money in Americans’ pockets,” John Donenberg, deputy director of President Biden’s National Economic Council, said in an emailed statement on Wednesday.

The agency, which protects consumers from financial exploitation, is making the move in response to customer complaints about getting dodged from later payment providers when disputing charges or trying to return items, CFPB officials said in a news conference Tuesday.

These loans have been welcomed by shoppers as an interest-free way to make purchases, from clothes to travel, and they allow borrowers to pay over time, usually in four installments over six weeks. Use of loans It rose during the pandemicThis helps spur the online shopping boom, the CFPB noted.

Similar to credit cards

An interpretive rule issued by the agency states that BNPL lenders are effectively credit card providers and therefore must provide consumers with the basic protections that come with buying things in plastic.

“When consumers check out and choose to buy now, pay later, they don't know whether they will get a refund if they return their product or whether a lender will help them if they don't get what they were promised,” CFPB Director Rohit Chopra said in a statement. “Regardless of whether a shopper swipes a credit card or uses buy now, pay later, they are entitled to important consumer protections under long-standing laws and regulations already on the books.”

In addition, BNPL lenders will have to provide users with periodic billing statements similar to those issued for traditional credit card accounts, according to the interpretive rule, which takes effect in 60 days, the agency said.

Under the new rules, BNPL lenders must now:

- Investigate disputes initiated by consumers, and pause payment requirements in the process.

- Returning returned products or canceled services to consumers' accounts.

- Providing consumers with periodic billing statements such as those received for standard credit cards.

Although BNPL lenders will face tougher government oversight, the new CFPB rule does not require servicers to verify borrowers' ability to repay loans, as consumer advocates have called for.

“We believe this interpretive rule largely relieves the industry of more onerous requirements, which would otherwise have to subject borrowers to an ability-to-repay test. On that front, this is a win,” said Jarrett Seaberg, an analyst at TD Coin. The Washington Research Group said in a report.

Conversely, consumers remain vulnerable to an industry that includes some companies that are not transparent about their business model, according to the American Education Fund PIRG.

“We are particularly concerned about young people, who are the main target demographic for BNPL plans and are encouraged to buy things they don't need and can't afford. They often don't understand what they're getting themselves into,” said Teresa Murray, PIRG's US consumer watchdog. “The disclosures are vague, and this needs to change,” he said Wednesday in an email statement.

The risk of accumulating debt

Buy now, pay later is increasingly being offered as an option alongside credit card payment, with the industry's five biggest players set to generate $24 billion in loans in 2021 – more than a 10-fold increase from $2 billion in 2019. According to To the CFPB.

Half of shoppers ages 25 to 44 use BNPL, according to Bankrate. This option could lead to spending of up to $84 billion, up 13% from last year, according to Adobe Analytics.

But BNPL plans can include Hefty fees for those who miss a paymentConsumer Reports warned last year.

Loans offered by companies including Affirm, Afterpay, Klarna, PayPal and Zip are typically not reported on consumers' credit reports, nor reflected in consumer credit scores. This has led to concerns that users may take on too much debt that is not transparent to lenders or other regulatory bodies.

Apple bucked the trend when it announced in February that it would report loans made through the Apple Pay Later program to Experian, a credit bureau.

“Extreme travel lover. Bacon fanatic. Troublemaker. Introvert. Passionate music fanatic.”

More Stories

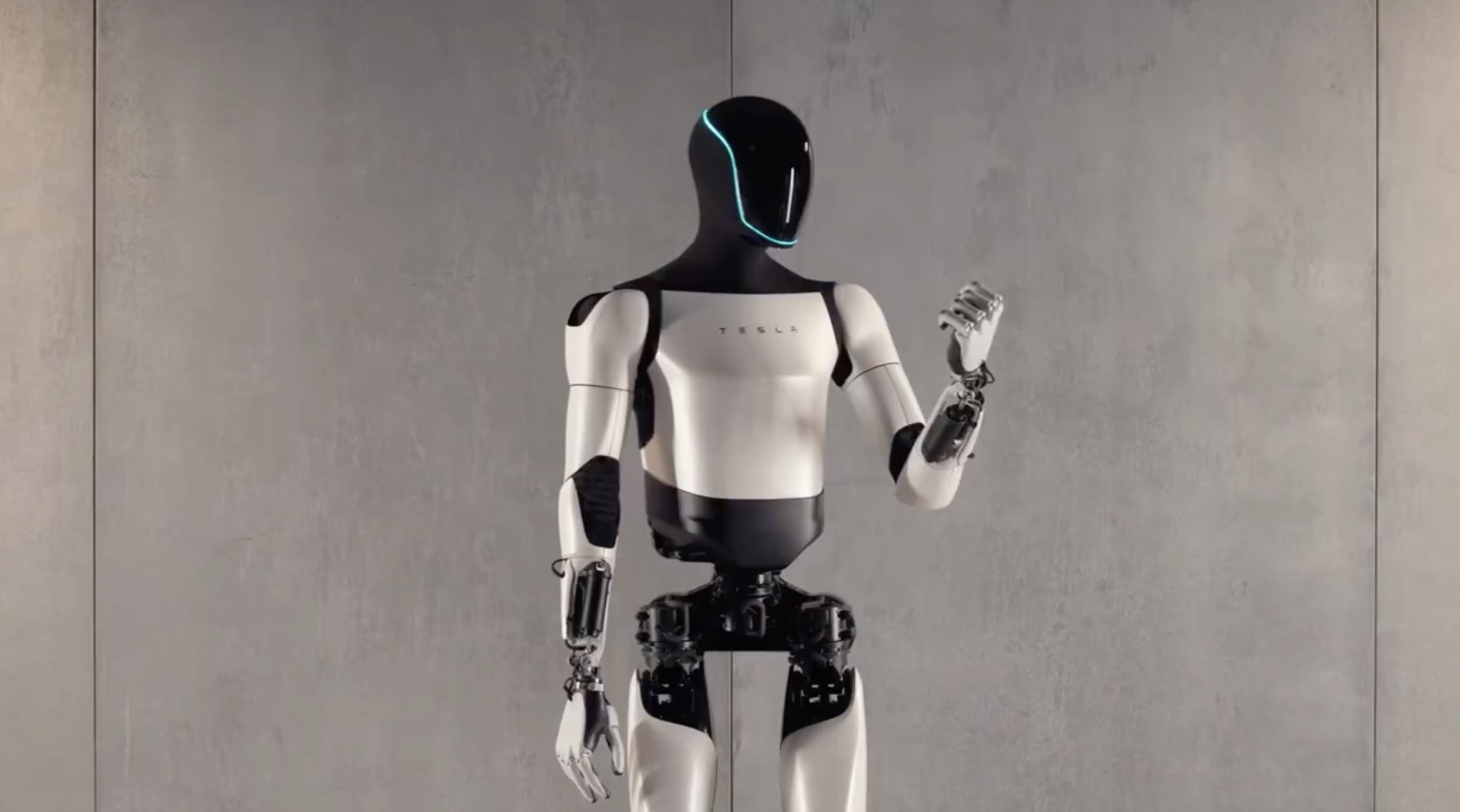

Before it goes on sale, Tesla has one more plan for its Optimus robots

We live in a 940-square-foot trailer in Laguna Beach: Take a look inside

Walmart shopper Bill Astle slammed as a 'thief' for not clearing his items in viral video – but insists he was doing his job