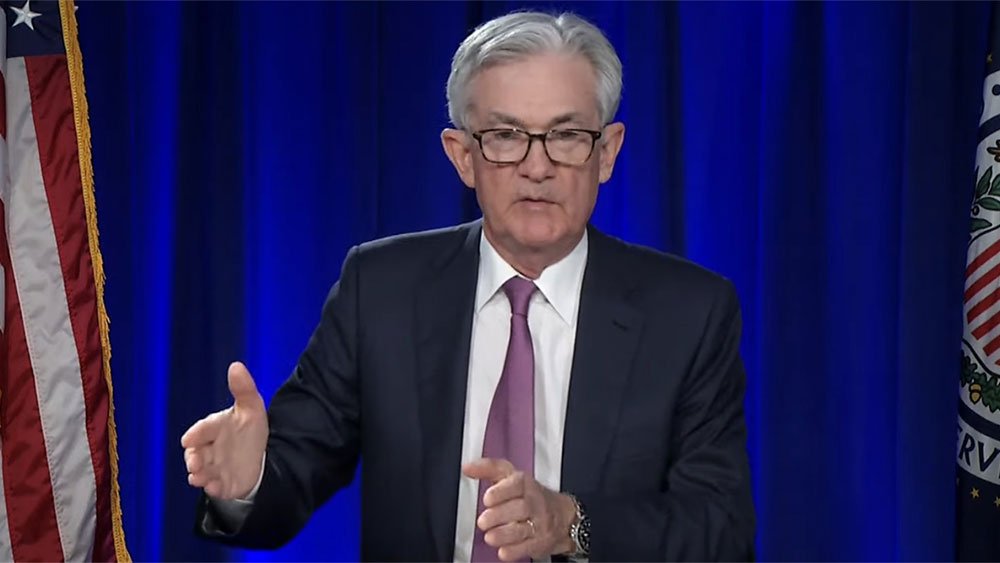

In his much-anticipated address to Jackson Hole, Wyoming, on Friday, Federal Reserve Chairman Jerome Powell said policy makers cannot let their guard down early, or they risk stabilizing high inflation. After the text was released, the S&P 500 index turned sharply lower.

X

“Restoring price stability will likely require maintaining a restrained political position for some time,” Powell said. “The historical record strongly cautions against premature mitigation.”

Powell said that lowering inflation would require a “sustainable period of sub-trend growth” for the US economy. He admitted that tightening Fed policy would bring “some pain to households and businesses”. But “much greater pain” may result from the failure to restore price stability.

The big question that preceded Powell’s speech was whether he would try to undo the dovish impression he left in his speech. Press conference on July 27. These comments helped the S&P 500 rise 18% from its June 16 closing low, pulling out of the bear market.

In the near term, markets are focused on whether the Federal Reserve will rise by 50 or 75 basis points on September 21. The odds shifted slightly in favor of a smaller movement with the release of inflation data in July ahead of Powell’s speech. The Fed chair, who suspended future guidance at his press conference on July 27, has taken no side on the size of the next rate hike. But the odds slipped toward a third straight rise of 75 basis points after Powell spoke.

When will the pivotal reserve be made?

The medium-term outlook for Federal Reserve policy looms especially large for investor risk appetite. The S&P 500 rally was built at least in part on the hope that the Fed would stop raising rates in early 2023 and start considering a rate cut around the middle of the year.

The message that the Fed could keep interest rates “high for longer,” St. Louis Fed President James Bullard recently said, was the last message investors wanted to hear from Powell. The Fed chair didn’t use those exact words. But he delved into the history of the Fed’s failures in the 1970s, pointing out the dangers of reversing interest rate hikes too soon. It is clear that today’s policy makers place this experience at the forefront of their interest.

Excerpt: Even if the economy enters a recession, the Fed may be slow to cut its benchmark interest rate — a sharp break from the way monetary policy has been done in recent decades to stem inflation.

Inflation rate is declining

Powell’s speech came as the Fed’s favorite inflation gauge showed that price pressures are easing. The PCE index fell 0.1% in July, bringing the annual inflation rate down to 6.3% from 6.8% in June.

Core prices rose 0.1% from June, as core inflation eased to 4.6%, the lowest level since October.

It is clear that inflation is coming down from its peak, as energy prices fall and supply chains recover. The unknown is how strong wage growth and large rent increases will keep inflation above the Fed’s 2% target.

Powell referred to lower inflation readings for July. But he added that the “one-month improvement” falls well short of what the Fed would need to be satisfied that inflation is low enough to pause interest rate hikes.

Fed history lesson

In a landmark speech on March 21, Powell took a tour of the history of the Fed’s soft landings to back up his claims that the current tightening could produce a similar outcome. Powell pointed to 1965, 1984 and 1994 as evidence that Fed tightening should not lead to a recession.

He also cited the Federal Reserve’s 2015 to 2019 tightening to bolster his case. And while the recession followed in 2020, it was Covid — not the Federal Reserve — that was to blame.

Fed Minutes Reduce Chances of Big Interest Rate Raise

Some economists speculated that Powell might give a somewhat less exciting history lesson at Jackson Hole. Nomura economists Aichi Amiya and Robert Dent write in their preview that Powell’s speech may include “an affirmation of the experience of the 1970s”.

They wrote: “A number of Fed participants recently referred to that era with a certain level of caution, usually to emphasize their preference for avoiding ‘stop and go.

Fed ‘tighten for longer’?

Other than just before the pandemic, the last time unemployment fell to 3.5% was in 1969. The Fed responded by raising the key interest rate to 9% to try to stymie a bout of wage-led inflation.

However, the Federal Reserve reversed course in 1970. It cut the federal funds rate to less than 4% by early 1971. This helped push the unemployment rate to 6%. “It wasn’t high enough to ease wage pressures,” Anita Markowska, Jefferies’ chief financial economist, wrote in a June 3 note.

“The Fed did not create enough stagnation to put pressure on inflation and stabilize inflation expectations,” she wrote. “Policy makers repeated the same mistake in the mid-1970s, going too hard and causing another recession, but then easing back too soon and allowing inflationary pressures to reassert themselves.”

The lesson from Markowska’s view: “When you experience a feedback loop between prices and wages, the Fed needs to stay tighter for longer.”

Take Powell in the ’70s

“During the 1970s, as inflation rose, the expectation of higher inflation became entrenched in the economic decision-making of households and firms,” Powell said. “The higher the rate of inflation, the more people expect it to remain high, and have built that belief into wage and pricing decisions.”

Powell said then-Fed Chairman Paul Volcker finally succeeded in breaking the back of inflation in the early 1980s after “several failed attempts to bring down inflation over the past 15 years.” Our goal is to avoid this outcome by acting decisively now.”

Relaxing financial conditions

Powell’s message may have been intended as a wake-up call to financial markets, which were already eyeing a reversal of the Fed’s tightening. This view of interest rate cuts in 2023 had the effect of easing financial conditions, and was reflected in lower market interest rates and a rise in the S&P 500, Dow Jones Industrial Average and Nasdaq.

Minutes from the Federal Reserve July 26-27 meeting He highlighted a “significant risk” that “high inflation could take hold if the public begins to question the committee’s determination to adequately adjust the policy stance”.

The minutes noted: “If this risk materializes, it will complicate the task of bringing inflation back to 2% and could significantly raise the economic costs of doing so.”

CPI Inflation Finally Falls – Much More Than Expected

To address this risk – that recent loosening of financial conditions is keeping inflation higher than others – some economists have been saying that Powell may want to raise more suspicion that the Fed’s pivot to lower interest rates is coming any time soon.

S&P 500 reacts to Powell’s speech

on Friday stock market workThe S&P 500 moved sharply lower in a choppy fashion as investors digested Powell’s speech. The S&P 500 is down 3.4%, the Nasdaq is down 3.9% and the Dow Jones is down 3% on Friday’s move.

During Thursday’s close, the S&P 500 fell 12.5% from its record closing high on January 3, but is up 14.5% since June 16. The Dow Jones Industrial Average is down 9.5% from its peak, while it is up 11.4% from its 52-week close. Lowest on June 17th. The Nasdaq remained 21.3% below its all-time closing high, after rising 18.7% from its June low.

Be sure to read IBD’s The Big Picture A column after each trading day for the latest information on the prevailing stock market trend and what that means for your trading decisions.

Please follow Jade Graham on Twitter Tweet embed To cover economic policy and financial markets.

You may also like:

IBD Digital: Unlock IBD Premium Stock Listings, Tools & Analytics Today

Why simplify this IBD tool burntthe classroom top stock

Profit from short-term trades: IBD SwingTrader

“Extreme travel lover. Bacon fanatic. Troublemaker. Introvert. Passionate music fanatic.”

More Stories

Trump attacks Fed for 'playing politics' with historic rate cut

Best National Burger Day Deals 2024

Yen rises, stocks mixed ahead of Fed decision: Market Report