Bitcoin (BTCIt also tested $38,000 overnight as the weekend began with uncertainty among traders.

The 3-day chart can be “introduced” to the week

information from Cointelegraph Markets Pro And the TradingView BTC/USD is trading around $39,000 after several attempts to break the $38,000 support.

The husband also saw a file Brief Boom Above $40,000 Friday Thanks to geopolitical developments, however, this continued for a few minutes before the return of the previous status quo.

Such “fake breakouts” to higher levels – which ended with Bitcoin coming full circle and liquidating short and long positions – were already familiar behavior for market participants this month.

Now, however, lower time frames are starting to show signs of a more significant downtrend on the horizon.

“3-Day BTC Candles Flirting with the 200 MA for the First Time Since the Covid Collapse,” Analytics Resource Indicators warned Twitter followers per day.

“If this is an introduction to what the weekly candle is going to do, make sure you have enough powder to take advantage of your next buying opportunity. This bounce can change your life.”

The 200-week moving average, which is currently just over $20,000 and still climbing, has been a historic bottom zone throughout Bitcoin’s life and has never been breached.

Achieving this will require a drop of 50% from the current spot price, and 70% from an all-time high – which BTC/USD has achieved in the past.

The covid crashFor example, it saw a 60% drop in a matter of days before an equally strong reversal triggered a new price model later in the year.

Bitcoin has been at the mercy of stock markets during the week, meanwhile, these stocks are heading for maximum weekly losses of 2.9% and 3.5% for the S&P 500 and Nasdaq, respectively.

Previously, the famous merchant Pentoshi clearly stated that he believed that a Crash style event on Wall Street It could dominate the markets this year.

Big and small bets on Bitcoin are constantly flowing

On the plus side, whale buying and smaller investor portfolio growth have provided reasons to cheer for long-term traders.

Related: Bitcoin derivatives metrics reflect the neutral sentiment of traders, but anything can happen

As Cointelegraph mentioned30,000 BTC left Coinbase on Friday, while exchange reserves mimic the declines seen in July and September last year — right before Bitcoin triggered a massive price increase.

The big smart whale has moved to 24,000 bitcoins today. Usually, such transactions refer to OTC deals. good sign for BTC dollars pic.twitter.com/SLwmAGwotf

– whale (whale_map) March 11, 2022

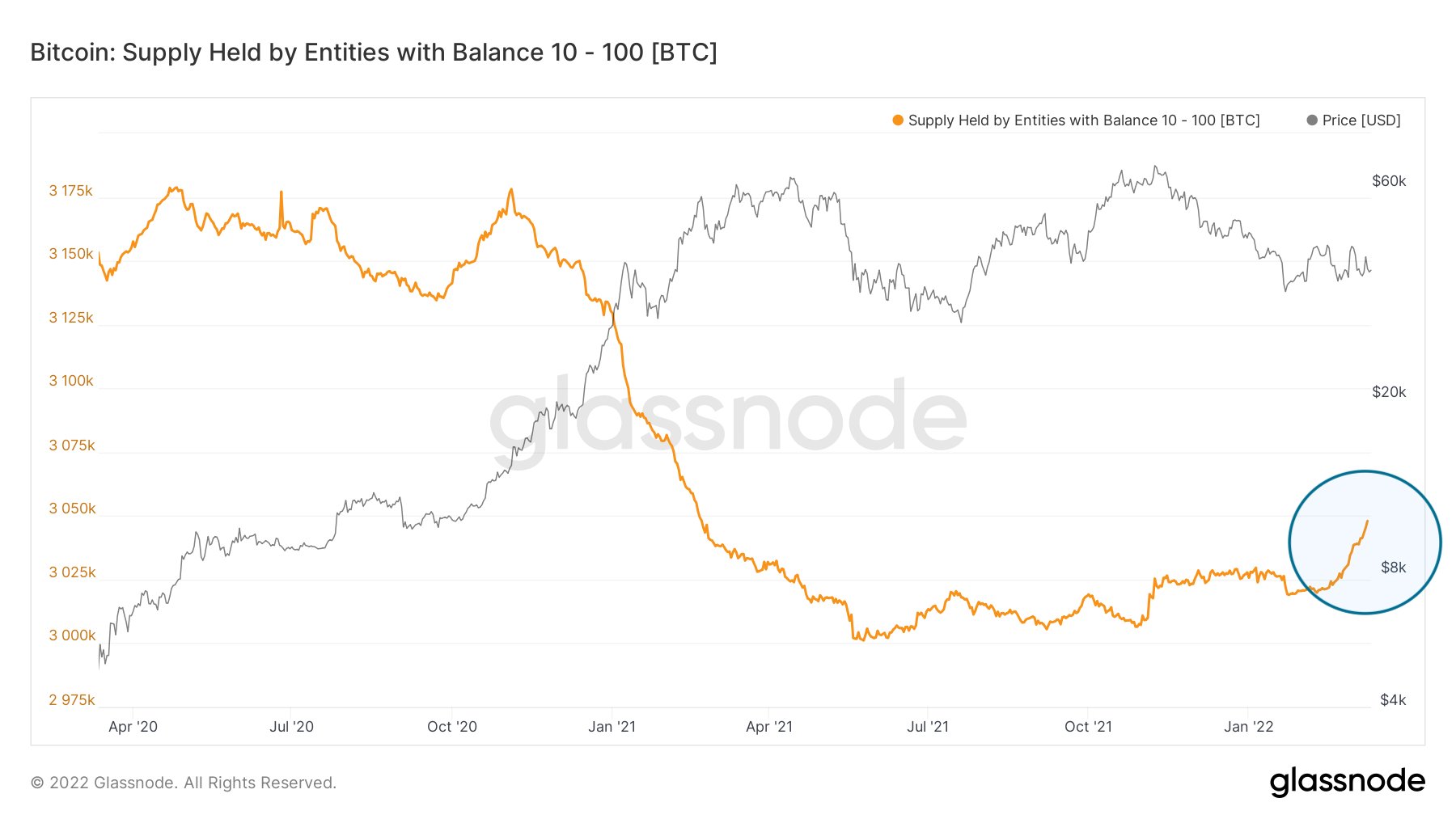

Lex Moskovsky, CEO of Moskovsky Capital, said, added About the portfolios, citing data from on-chain analytics firm Glassnode.

“These guys rightfully sold the meat of the $10,000 to $50,000 Bitcoin movement.”

The accompanying chart showed that the percentage of Bitcoin supply now held by entities — one or more wallets that are supposed to have the same owner — has now reached its highest levels in a year.

“Extreme travel lover. Bacon fanatic. Troublemaker. Introvert. Passionate music fanatic.”

More Stories

Best National Burger Day Deals 2024

Trump attacks Fed for ‘playing politics’ with historic rate cut

Tesla “Magnificent Seven” (TSLA) shares report third-quarter earnings this week. Is it a buy before the results?