- Bitcoin has been experiencing a psychological boom, making a correction unlikely at the moment.

- However, when fundamentals eventually take over, panic may ensue.

Fears are growing that the market will overheat as Bitcoin rises [BTC] The RSI crossed $68,000, breaking a four-month decline, although the RSI is seeing a sharp decline.

As a result, trading just above this critical level could indicate a potential top for Bitcoin. If this range is confirmed as a resistance point, a price correction may be on the horizon, which could lead to a mass capitulation. but,

Bitcoin Boom – Psychology Before Basics

First, it is necessary to consider that Bitcoin is strongly influenced by macroeconomic factors.

Right now, there are a bunch of events going on – like the post-halving phase leapthe near end of the election cycle, the “Uptober” madness, and federal interest rate cuts – combined to push Bitcoin to $68,000 in just ten days without any strong pullback.

This is important because although key technical indicators are pointing to a near-term reversal, these macro factors may reinforce the belief of major holders that this is a major buying area.

In other words, big players may still see this level as an opportunity, and this psychological momentum may attract more buyers, supported by rising FOMO as market sentiment rises.

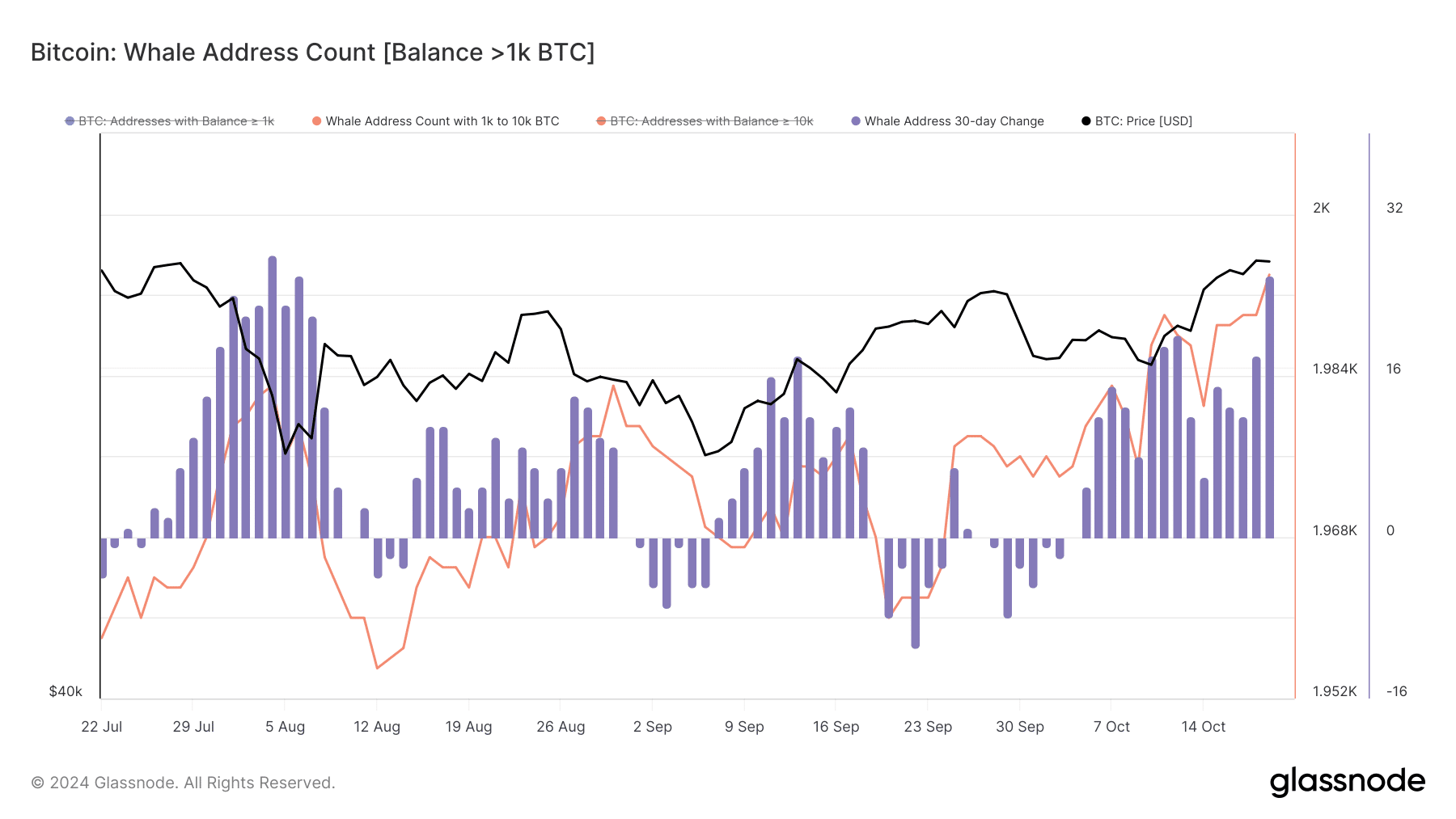

Source: Glassnode

This is supported by the rise in whale activity: addresses holding 1,000 to 10,000 Bitcoins reached their highest level in three months. The recent big rally occurred alongside a 5% daily price rise, pushing Bitcoin past $66,000.

In simple terms, whales played a major role in countering the downward pressure. Since the beginning of October, their activity has reinforced AMBCrypto's initial hypothesis: macro factors attract big players.

Overall, this cycle appears to be psychologically driven. Therefore, despite the bearish attempts to sell Bitcoin, the likelihood of a major correction seems slim at the moment.

Market noise leads the way to $73K

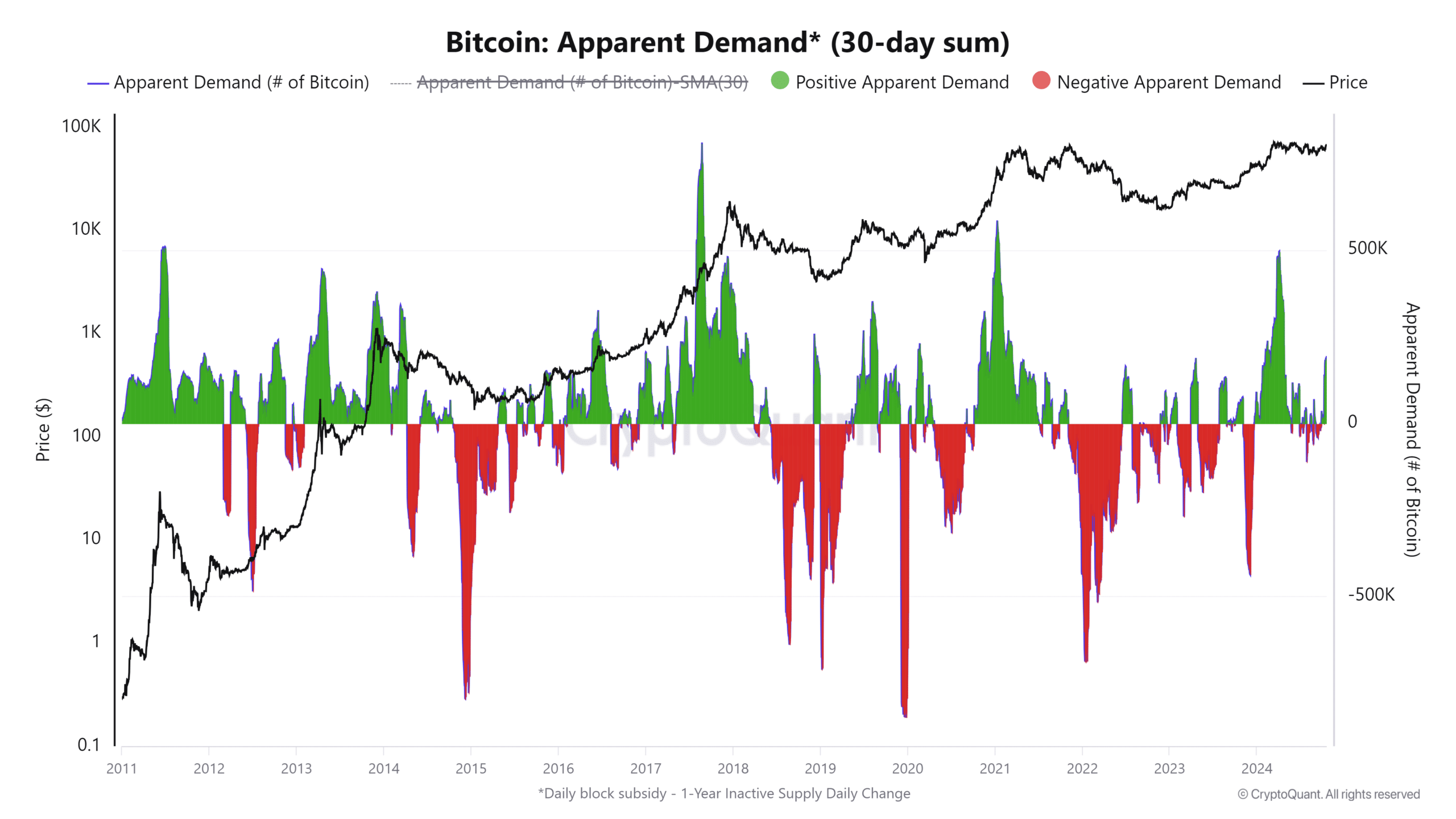

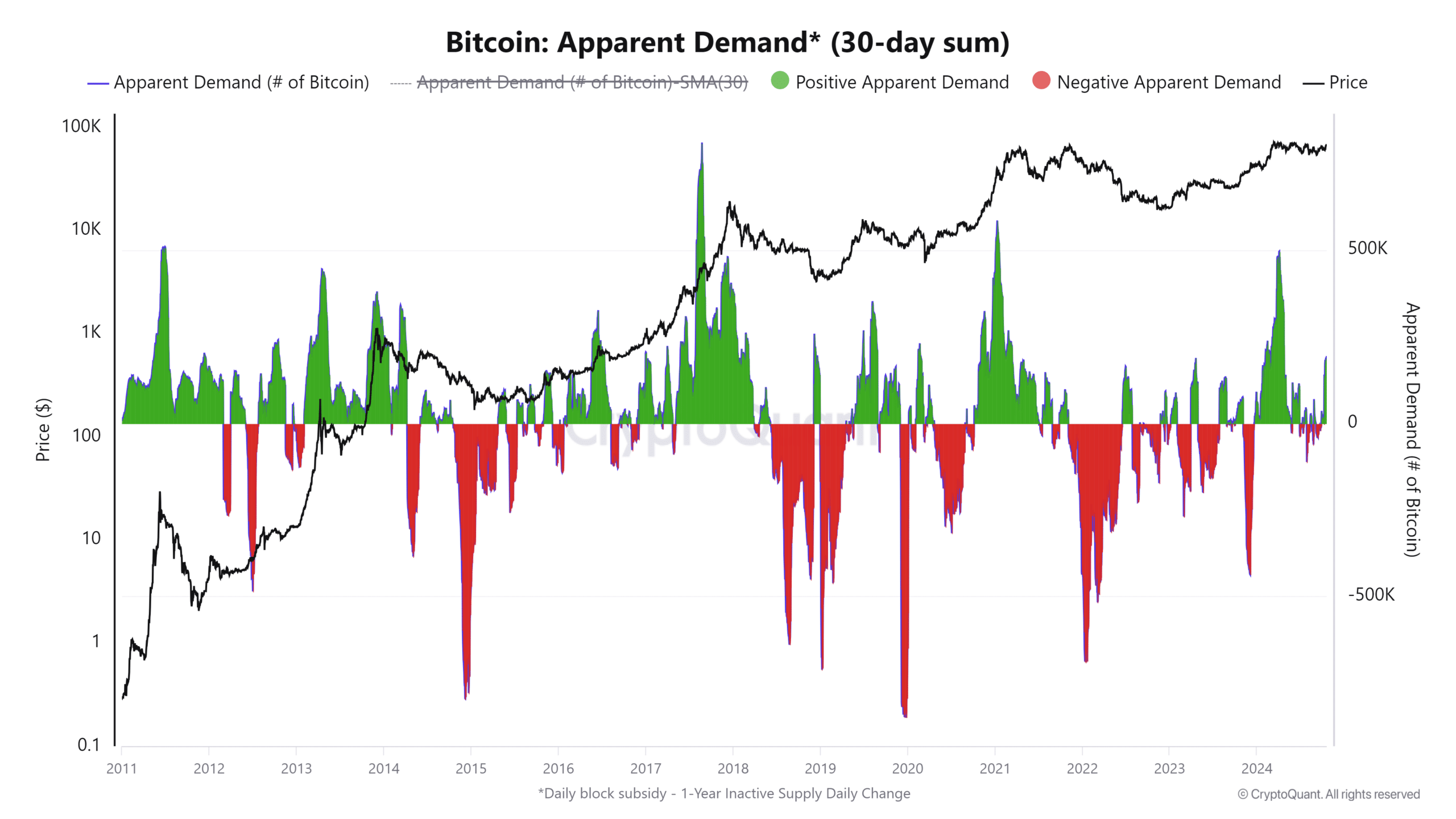

Historically, the half year has been a reliable indicator of when an up cycle might occur. Increases in 30-day average demand (in green) have consistently coincided with reductions in Bitcoin supply during halving events.

These supply reductions usually lead to long-term increases, generating huge returns for stakeholders.

Source: Cryptoquant

Interestingly, even if the fundamentals do not appear immediately, widespread anticipation alone can lead to a breakout.

Is your wallet green? Check out our Bitcoin Profit Calculator

This cycle is a prime example of this: the market was rife with expectations of a halving-driven rally, and it is true that the price of Bitcoin rose to $68,000 in a remarkably short time frame.

However, if whale activity continues this upward trend – which seems likely – it is possible that Bitcoin could reach an all-time high of $73,000 before the end of the fourth quarter.

“Extreme travel lover. Bacon fanatic. Troublemaker. Introvert. Passionate music fanatic.”

More Stories

The Dow Jones, Nasdaq and S&P 500 indexes decline as Treasury yields reach their highest level since July.

Stocks and bonds fall as Fed and election risks impact: Markets wrap

Dow Jones and Rupert Murdoch's New York Post sue AI company for 'unlawful copying' | Artificial Intelligence (AI)