- Higher difficulty increased miners' daily revenue

- Many miners have cashed out their Bitcoin, indicating that the price of the coin may decline

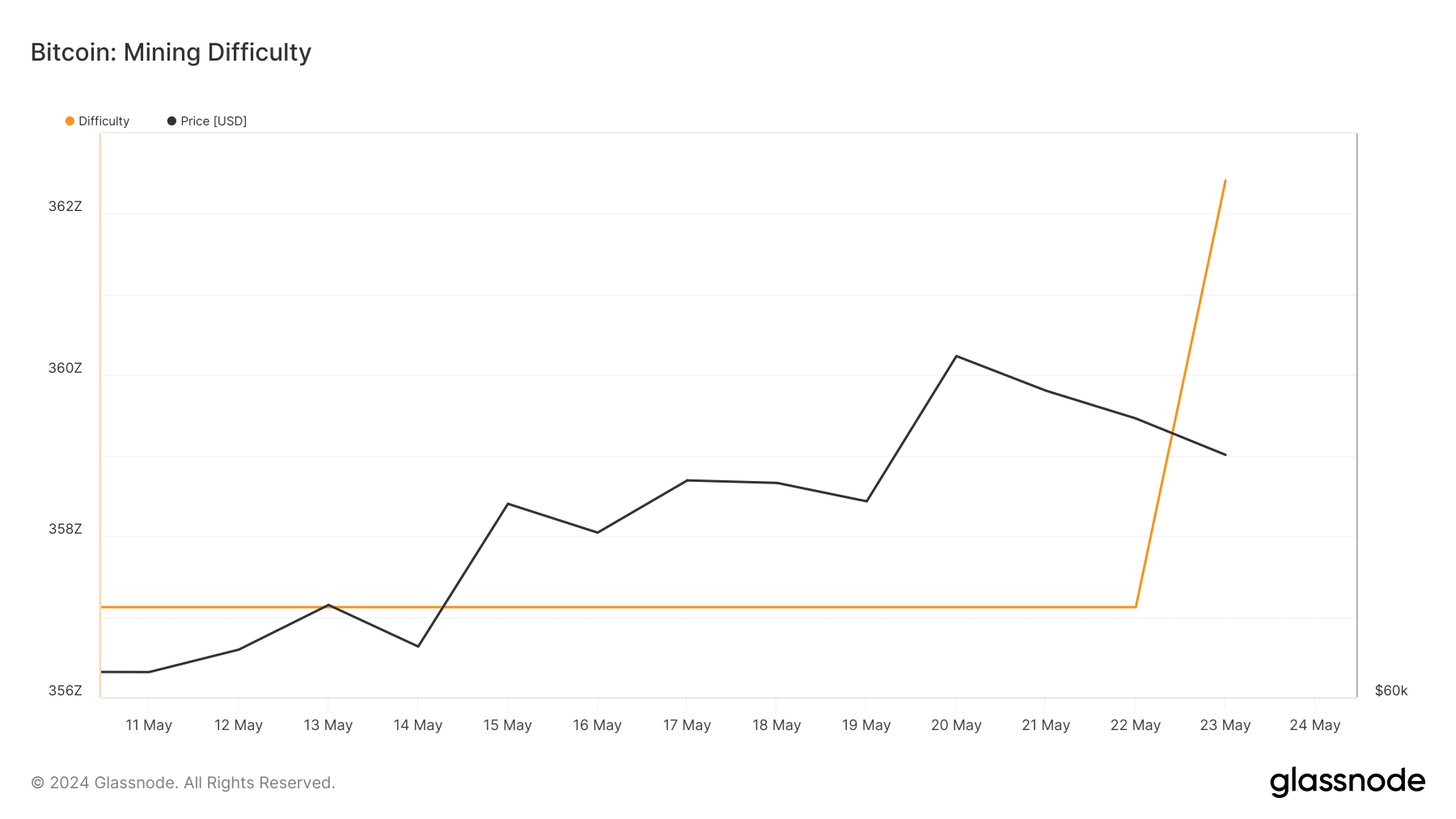

According to on-chain data from Glassnode, Bitcoin [BTC] Mining difficulty rose to a significant high from the lows on May 22. Bitcoin mining difficulty measures how difficult and time consuming it is to find the appropriate hash for each block.

Mining difficulty does not always affect the value of BTC. However, it affects its perceived value and rarity. An increase in difficulty indicates an increase in hashing power. In contrast, blocks may not be resolved faster and the block time may be as long as 10 minutes.

In terms of price, a He increases On this scale it can be bullish. This is because miners may be attracted to validate more transactions on the network.

Source: Glassnode

However, mining difficulty was not the only measure of the network's significant upside. In fact, the other metric that followed was Bitcoin's hash rate.

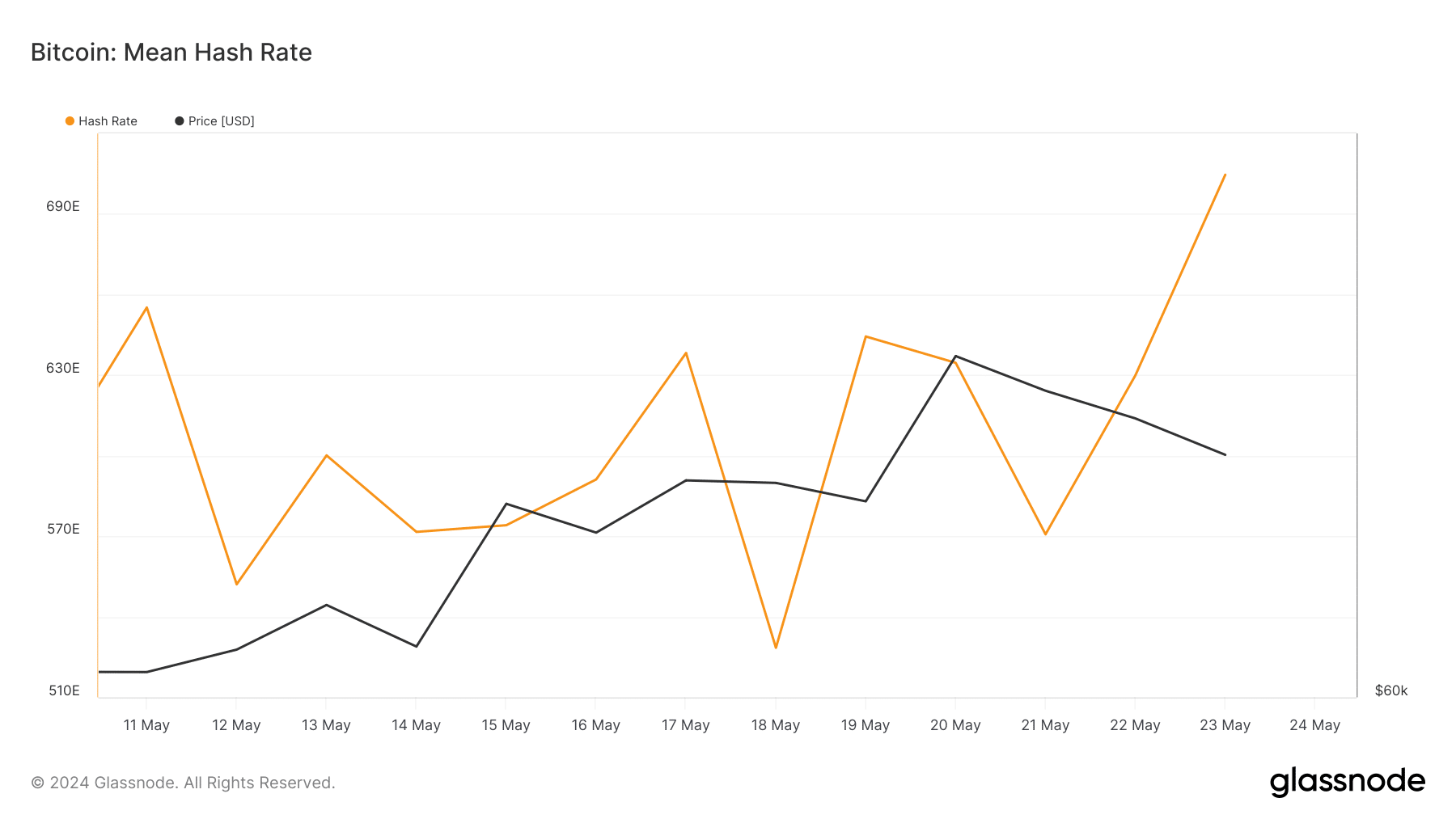

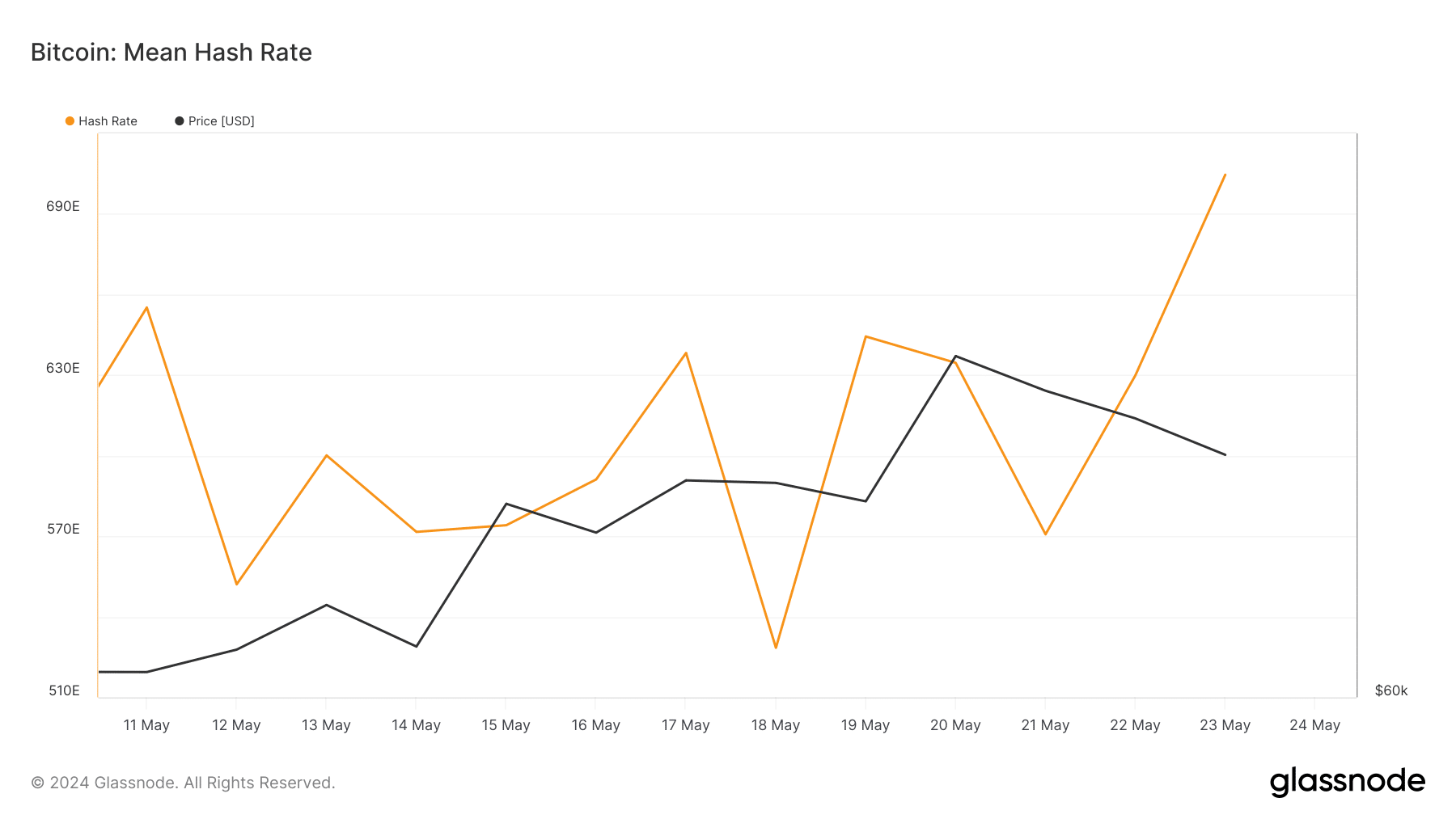

As the difficulty increases, the revenues also rise

If Bitcoin The hash rate is highIndicates that the network is safe and healthy. For investors, this rise is a reassurance that buying Bitcoin can be profitable in the long term. However, this condition only works if the market condition is in a bull phase.

On the other hand, a significant decrease in hash rate indicates changes or risks to the network. In such cases, miners may find it difficult to make profits from their operations.

Source: Glassnode

As expected, the impact of the increase in mining difficulty and hash rate was reflected in miners' revenues. In fact, at the time of writing, on-chain data revealed that miner revenue amounted to 558,057 BTC.

This seems to indicate that operators have confirmed more new transactions on the block than on May 21.

Not everyone is HODLing

AMBCrypto also considered relocating Miner Net. At press time, the gauge had a reading of -2,748.69 BTC. Miner Net Position Change tracks the 30-day change in the supply of Bitcoin held at miners' addresses.

When this measure positiveIt means that miners collect more coins. However, the recent decline over the past two weeks means that miners are withdrawing their holdings.

As such, there is a possibility that Bitcoin mining will become more difficult. As for price action, this could lead to another decline for the cryptocurrency.

At press time, Bitcoin was worth $68,291, having risen less than 1% in 24 hours after a lot of sideways movement. The price action is worth monitoring as Bitcoin holders may look for other opportunities to cash in in the future.

BTC trading decline

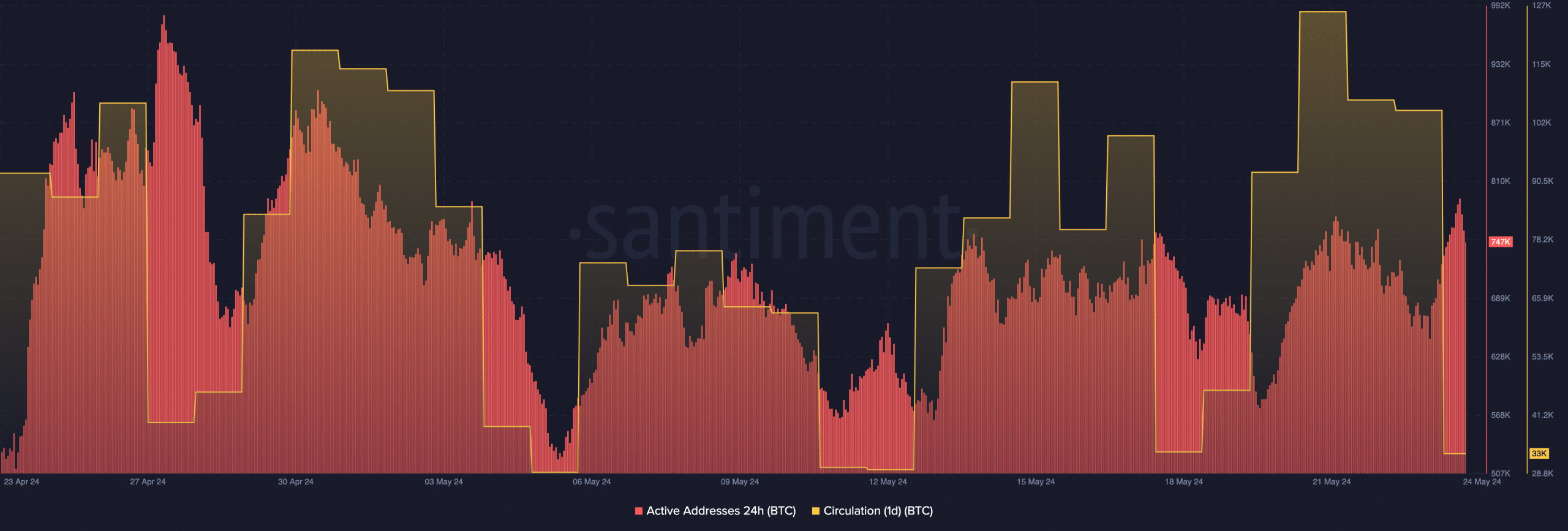

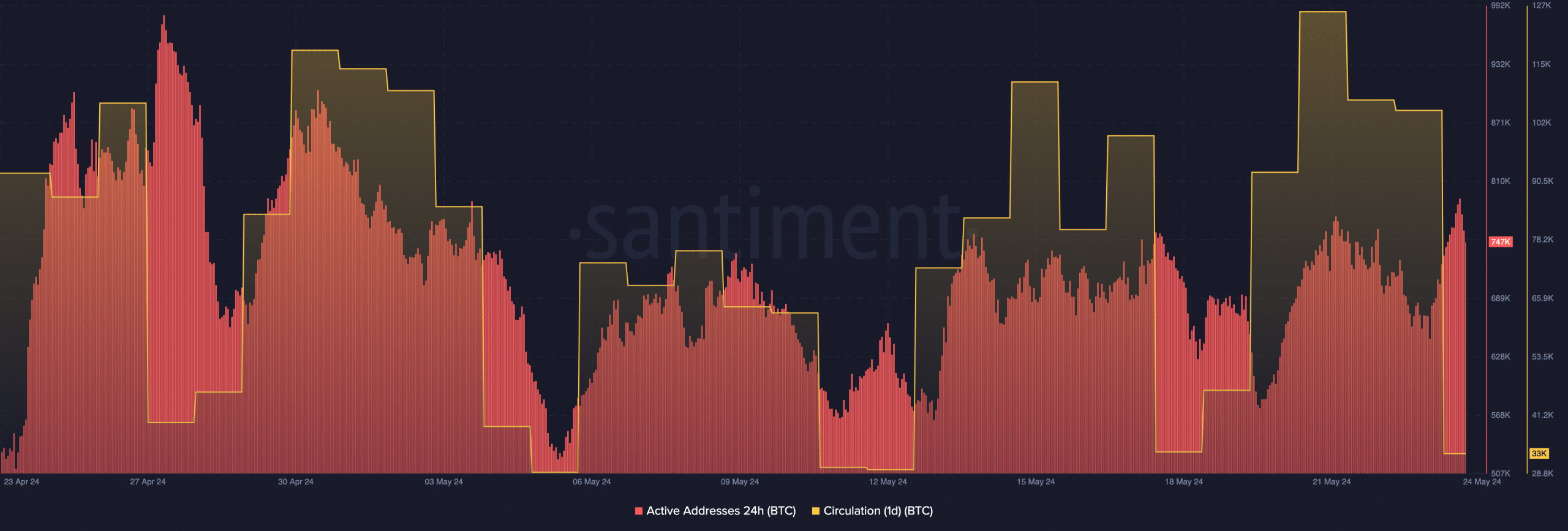

From a on-chain perspective, AMBCrypto also looked at 24-hour active addresses. According to Santiment, the number of active 24-hour addresses on the Bitcoin network reached 747,000.

This indicates a significant rise from where the gauge was on May 23. Active addresses measure users' daily interaction on the blockchain, meaning the number of Bitcoin transactions has risen since then.

For the price, there may be a spike in activity Incentive Increase in the price of the currency. However, this metric alone cannot determine the next direction for Bitcoin. Hence, it is useful to consider the distribution as well.

Source: Santiment

At the time of writing, one-day trading had fallen to 33,000, meaning that the number of coins involved in transactions had decreased.

Is your wallet green? Check out our Bitcoin Profit Calculator

Given the rise in Bitcoin mining difficulty and activity on the network, the price of the cryptocurrency could see an increase in the medium term. On the targets front, the value could rebound towards $73,000.

“Extreme travel lover. Bacon fanatic. Troublemaker. Introvert. Passionate music fanatic.”

More Stories

Best National Burger Day Deals 2024

Trump attacks Fed for ‘playing politics’ with historic rate cut

Tesla “Magnificent Seven” (TSLA) shares report third-quarter earnings this week. Is it a buy before the results?