Biden will also call on Congress to provide a one-year credit of up to $10,000 to families who… Sell their new homes, as long as their homes are below the median price in their county. The idea is to free up part of the market that has been effectively frozen, as thousands of homeowners cling to mortgages as low as 2 or 3 percent and avoid buying. New home at a much higher rate.

The proposals build on the administration's previous moves to build more homes, address rising rents and help first-generation buyers get a down payment. The moves come as housing remains one of the most inaccessible parts of the economy and remains a key issue for voters in this year's elections.

“This plan is the most important set of housing recommendations in the union state in more than 50 years, and I say that because I researched them all,” said David Dworkin, president and CEO of the National Housing Conference. A former Treasury Department official.

Durkin stressed that the administration's most important housing plan was its commitment to building and preserving two million homes.

“We have a big gap that will make a big impact,” he said. “The supply side drives housing prices, and this is the most ambitious housing supply agenda in modern history.”

The housing market has been strained from many directions. The country faces a shortage of millions of homes, with a lack of investment dating back decades. Rents have also risen during the pandemic, quickly becoming the main driver of inflation. Additionally, the Federal Reserve's battle to tame inflation has led to higher mortgage rates that continue to push many buyers out of the market.

Further afield, Biden's efforts will also be tested by the strange nature of the post-pandemic market. Construction of hundreds of thousands of new units was completed last year. But much of it is skewed toward the higher end of the market, and housing experts have become concerned about the simultaneous hollowing out of affordable options. Senior White House officials say many of the White House efforts target affordable housing and are designed to open up options to middle-class buyers.

“President Biden will lay out the boldest plan to lower housing costs and expand access to housing in decades,” Lael Brainard, director of the National Economic Council, said in a statement. “He will call on Congress to pass his plan to open up the housing market by providing mortgage relief to first-time homebuyers and homeowners selling their new homes and supporting the private sector in building 2 million homes, while taking new administrative actions to reduce closing costs and make our rental markets fairer.

Meanwhile, some housing experts are raising concerns that new loans could pump more demand into the market while supply is still catching up — which could push prices higher.

“This will likely have a very limited impact on housing prices — increasing the number of buyers will, overall, increase home prices for everyone,” said Kyle Pomerleau, a senior fellow at the American Enterprise Institute, a right-wing think tank. “It's very clear.”

Biden will also call for expanding the low-income housing tax credit to build or preserve 1.2 million affordable rental units. He also proposes a new neighborhood home tax credit, the first tax provision for building or renovating affordable homes. Biden will unveil a new $20 billion competitive grants fund as part of his budget, expected next week, which he will do. Support the construction of affordable multi-family rental units and remove barriers to housing development.

As he has done before, Biden is also calling on Congress to provide up to $25,000 in down payment assistance to first-generation homebuyers.

While the home purchase program is unlikely to gain traction in Congress, the administration has also pointed to several unilateral actions it is taking to provide homebuyers and renters with financial relief.

These include steps taken to reduce closing costs for homebuyers, which the White House asserts can add thousands of dollars to the purchasing process and put it out of reach. The Federal Housing Finance Agency has approved pilot programs and new policies to reduce these costs, including a program to waive title insurance when refinancing a home, as well as the Consumer Financial Protection Bureau's crackdown on “anticompetitive” closing costs. The White House said the Treasury Department will also take additional measures to reduce home insurance costs.

It also pushed the White House to take unilateral action to help renters. The Federal Trade Commission last fall proposed banning misleading and hidden fees in several areas, including residential rental agreements, while the Department of Housing and Urban Development also identified “non-rental fees” prohibited within rental assistance programs. However, in the past, the White House has been criticized for not being more aggressive in its efforts to help struggling renters.

“President Biden is absolutely right to put forward his plans to make housing more affordable,” said Lindsay Owens, executive director of the Groundwork Collaborative, a left-leaning think tank. “Housing costs are at the forefront of Americans’ concerns, and this is an important piece of unfinished business for the president.”

“Extreme travel lover. Bacon fanatic. Troublemaker. Introvert. Passionate music fanatic.”

![German Mini Walk Map “Pikmin Bloom” Released!! Trandeco offers and interesting outdoor events guide[Playlog #627]|. Famitsu application[موقع معلومات ألعاب الهاتف الذكي]](https://app.famitsu.com/wp-content/uploads/2024/05/23762636e4c238cb764af53b30bb90a3-506x254.jpg)

More Stories

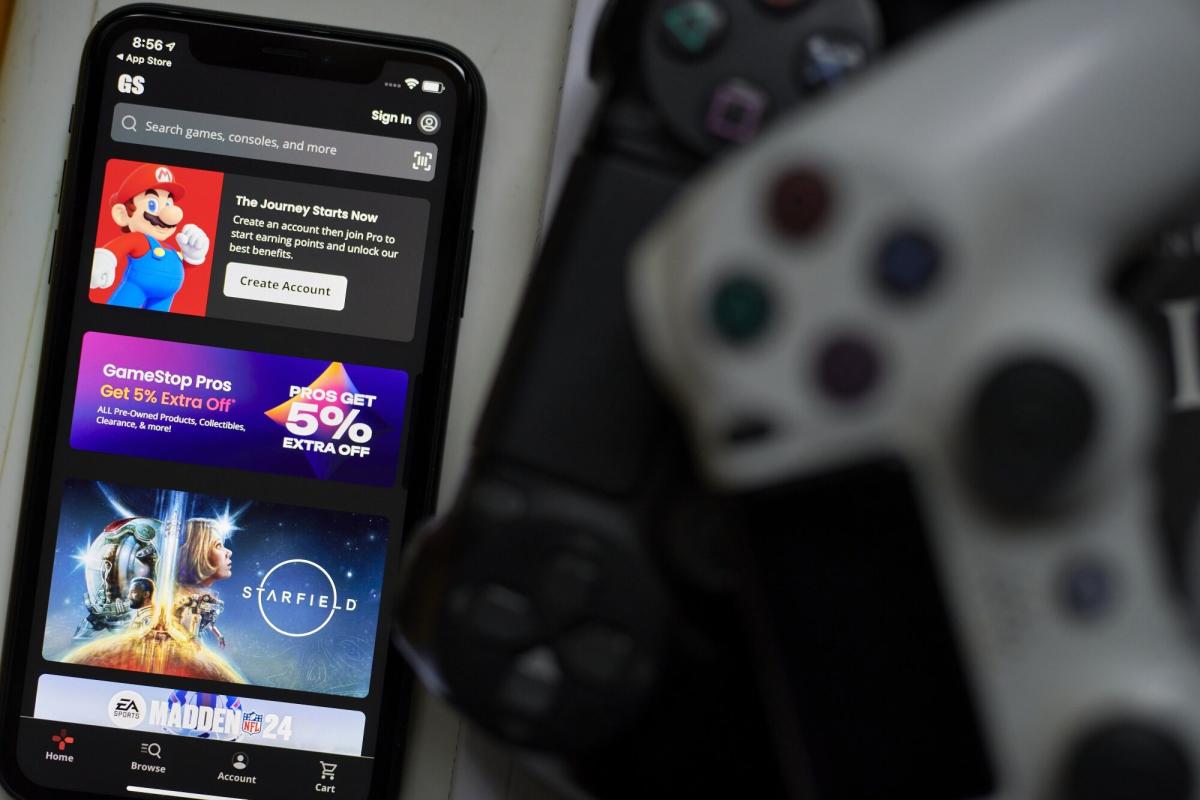

GameStop and AMC shares rose as traders pounced on Meme shares

Airlines are trying to stop Biden from imposing the “junk fees” rule.

New rules to reform electrical grids could boost wind and solar power