- After a breakout from the H&S pattern, there is a strong possibility that SOL will reach $190 before November 2024.

- SOL's open interest jumped 18%, indicating a build-up of new positions amid the recent breakout.

Solana [SOL]the world's fifth-largest cryptocurrency, turned bullish after breaking out of a bullish price action pattern. This breakout not only changed the sentiment among investors and traders but also raised hopes that SOL would soon rise in the coming days.

Solana technical analysis and key level

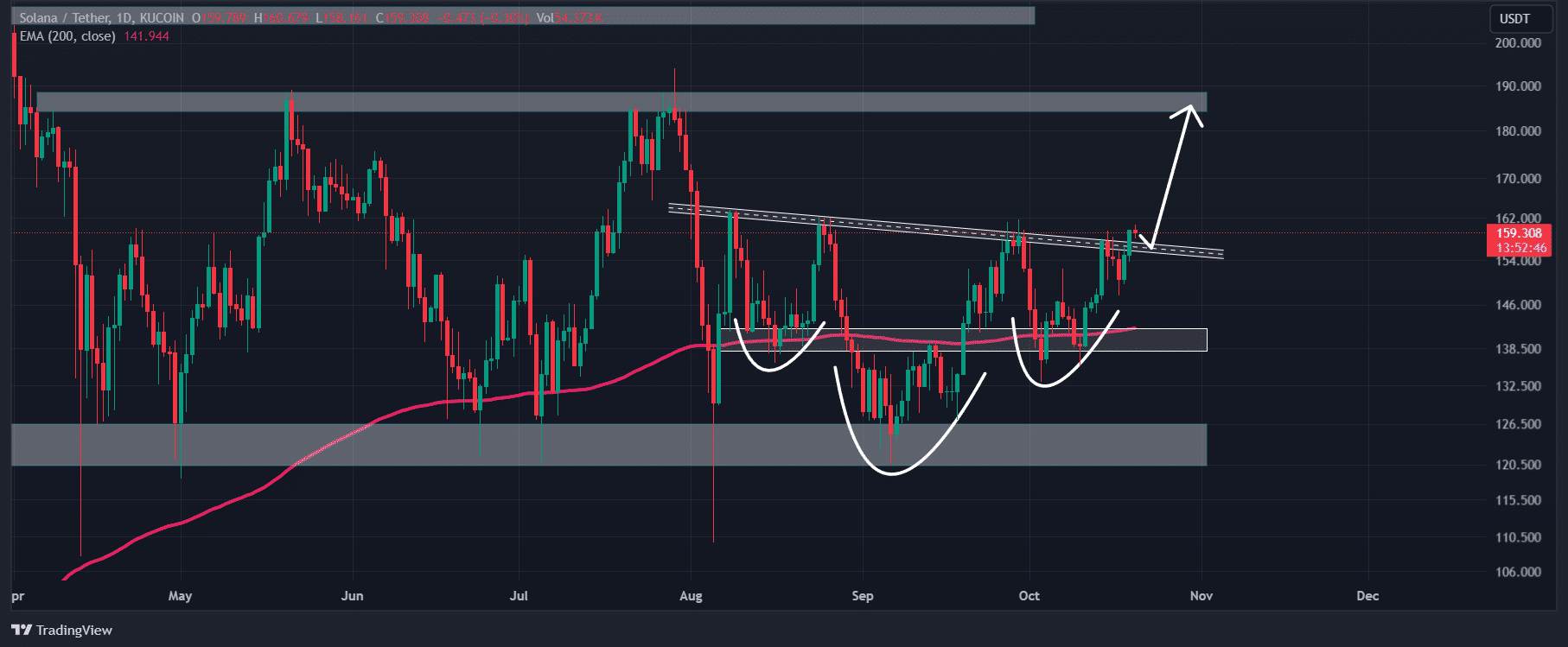

According to AMBCrypto's technical analysis, SOL recently broke out of a bullish inverted head and shoulders pattern on the daily time frame. Based on historical data, when an asset breaks out of this H&S pattern, it tends to rise significantly.

This time, SOL has seen a bullish breakout over a longer period and is aiming for a higher rally in the coming days.

Source: Trading View

Solana forecast for November 2024

Despite this bullish outlook, SOL's rise may not be as obvious. A few resistance levels may pose obstacles to an asset's upward momentum.

If SOL closes a daily candle above the $161 level, there is a strong possibility that it will rise by 18%, hitting the next resistance level of $190 in the coming days.

However, given the current market sentiment, it seems that SOL could achieve this level before November 2024.

Bullish on-chain SOL metrics

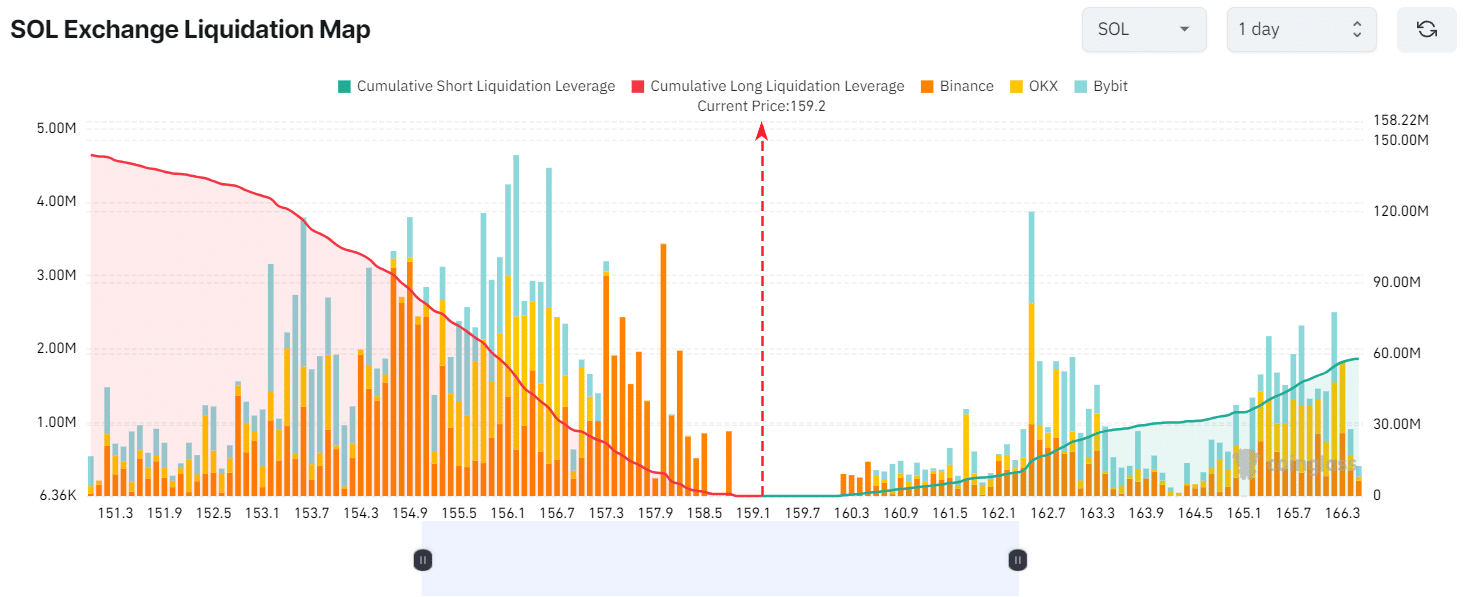

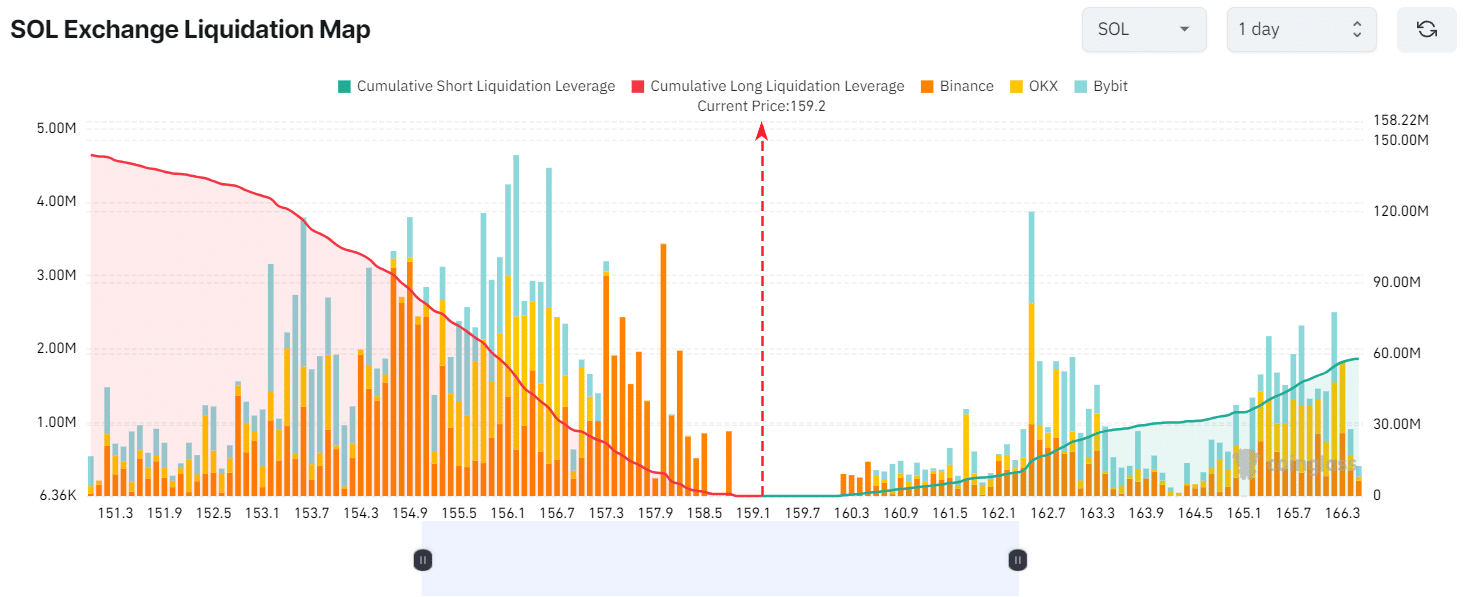

On-chain metrics also support SOL's positive outlook. According to on-chain analytics firm Coinglass, the key liquidation levels are currently $156.6 on the downside and $162.5 on the upside, with traders excessively using leverage at these levels.

Source: Coinglas

According to the data, short sellers placed bets worth more than $14.46 million at the $162.5 level, believing that the SOL price would not exceed it. On the other hand, bulls placed bets worth $36.24 million on the $156.6 level, believing that the price of the asset would not fall below that level.

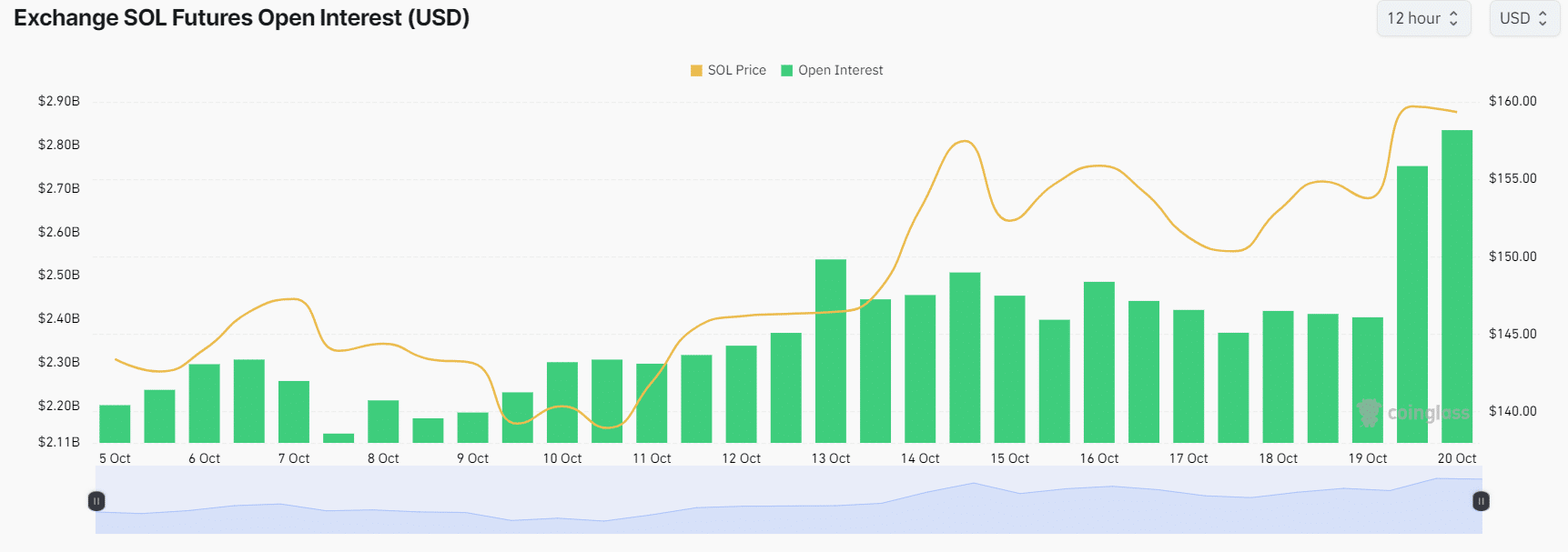

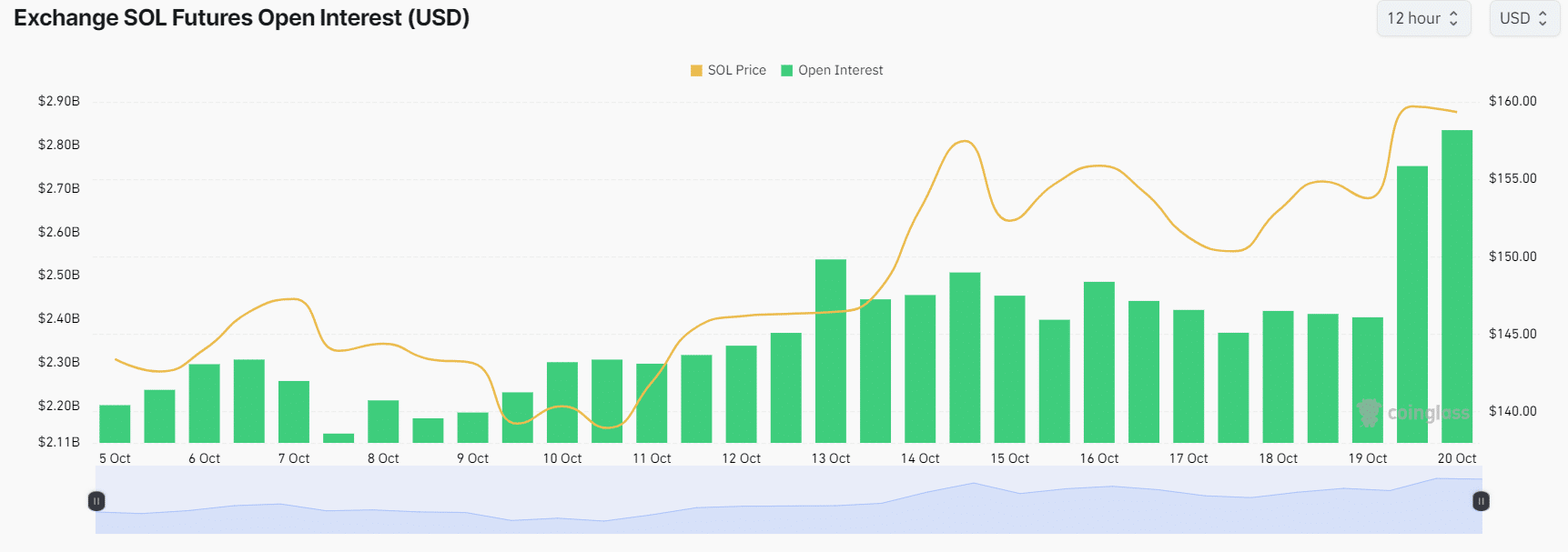

High open interest

As of now, SOL's open interest has risen significantly, indicating strong interest from traders following the breakout. Over the past 24 hours, its value has increased by 17.8%.

This marked rise in open interest indicates an accumulation of new positions during this period. Additionally, it represents the highest level since the beginning of October 2024.

Source: Coinglas

In fact, SOL's buy/sell ratio stood at 1.11 at press time, indicating a strong bullish sentiment among traders.

Market sentiment among traders

Combining all these on-chain metrics and technical analysis, it appears that bulls are currently dominating the asset. This may support SOL and help it reach the $190 level in the coming days.

Is your wallet green? Check out SOL's earnings calculator

This bullish outlook receives additional support from the upcoming presidential elections in the United States. Historical data shows that October often brings bullish trends in the cryptocurrency market, especially before major events such as elections.

This could sustain Solana's upward momentum.

“Extreme travel lover. Bacon fanatic. Troublemaker. Introvert. Passionate music fanatic.”

More Stories

The Dow Jones, Nasdaq and S&P 500 indexes decline as Treasury yields reach their highest level since July.

Stocks and bonds fall as Fed and election risks impact: Markets wrap

Dow Jones and Rupert Murdoch's New York Post sue AI company for 'unlawful copying' | Artificial Intelligence (AI)