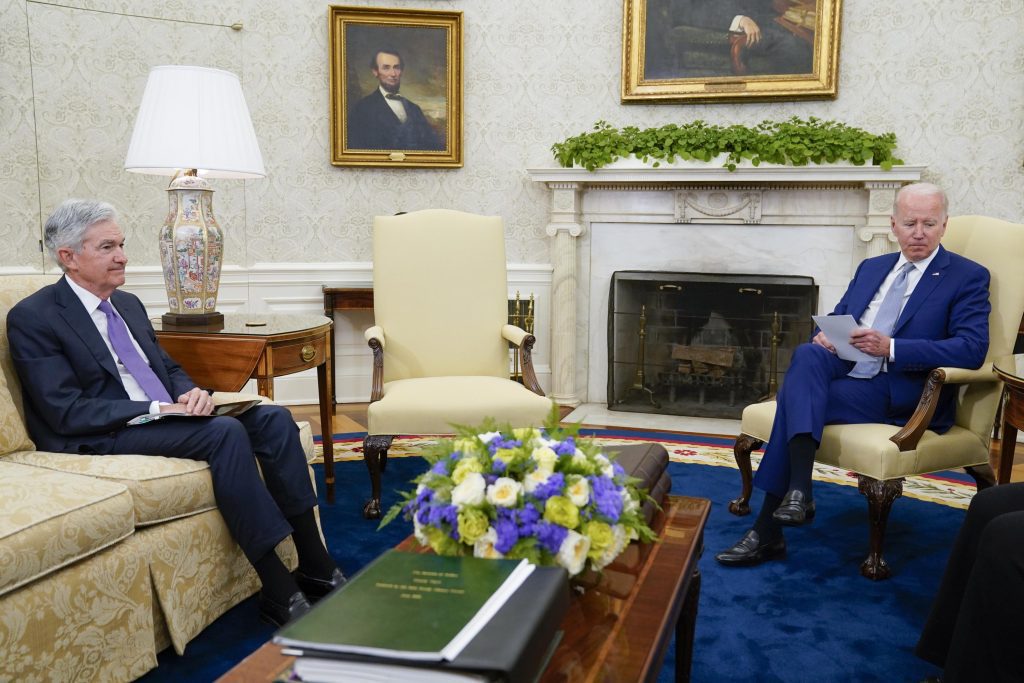

Washington (AFP) – Focused on relentless price hikesPresident Joe Biden mapped out his anti-inflation strategy Tuesday with the Federal Reserve chairman, as the economy’s fate and political prospects increasingly depend on the government’s central bank actions.

Biden hoped to prove to voters that he was attuned to their concerns On rising gasoline, groceries and other prices, while still insisting that the independent Fed will be free of political pressure.

Like Biden, the Fed wants to slow inflation without pushing the US economy into recession, a task all too sensitive to include in a benchmark interest rate hike this summer. The president said he will not try to steer this course as some previous presidents have.

“My plan to tackle inflation begins with a simple proposition: Respect the Federal Reserve, respect the independence of the Federal Reserve,” Biden said.

Sitting on a sweltering day in late spring was Biden’s latest effort to show his dedication to containing an 8.3% jump in consumer prices over the past year. Rising gas and food costs angered many Americans heading into the midterm elections, jeopardizing Democratic control of the House and Senate.

Biden is running out of options on his own. His previous attempts — the release of oil from the strategic reserve, improved port operations, and calls to investigate price gouging — have failed to produce satisfactory results. The higher prices undermined his efforts to highlight the low unemployment rate of 3.6%, leaving a growing sense of pessimism among Americans.

Tuesday’s meeting was the first since Biden renominated Powell in November to lead the central bank, and came two weeks after his confirmation. for a second term by the Senate.

It also represents something of a Biden reversal as inflation weighs heavily on voters’ minds. The president asserted in April 2021 that he was “very careful about not talking” to the independent Federal Reserve and wanted to avoid being seen as “telling them what they should and shouldn’t do”.

Initially, the White House, along with the Federal Reserve, portrayed rising inflation as a temporary side effect of supply chain issues as the United States emerged from the pandemic. Republican lawmakers were quick to criticize Biden’s $1.9 trillion coronavirus relief package last year, as he pumped too much money into the economy and caused more inflation. This narrative has had some bearing with prominent economists arguing that fiscal support was excessive even though it helped the labor market return.

The administration retracted its previous statements. Treasury Secretary Janet Yellen told CNN Tuesday night that she did not fully understand the impact of unexpectedly large shocks and supply bottlenecks on the economy. “Look, I think I was wrong at the time about the path inflation would take,” she said. But we know the Fed is now taking the steps it needs to take. It’s up to them to decide what to do.”

Inflation has shown signs of moderation but is likely to remain well above the Fed’s 2% target through the end of this year. Gas prices are expected to continue rising, especially now that the European Union has agreed to cut 90% of its oil purchases from Russia.. This will force the European Union to buy more oil from elsewhere, and that drove oil prices to $115 a barrel on Tuesday.

This was only the fourth meeting between the president and the Fed chair, although Powell often eats breakfast once a week with Treasury Secretary Janet Yellen, who also attended Tuesday’s meeting with Brian Dees, director of the White House National Economic Council. .

Prior to the meeting, Biden suggested that he and Powell were in agreement on tackling inflation.

“My predecessor insulted the Federal Reserve, and previous presidents inappropriately sought to influence its decisions during periods of high inflation,” Biden said in an opinion piece for the Wall Street Journal on Monday. You have appointed highly qualified persons from both parties to lead that institution. I agree with their assessment that the fight against inflation is our biggest economic challenge at the moment.”

In contrast, President Donald Trump has repeatedly attacked Powell after the Fed chair oversaw moderate rate increases in 2018 and continued his public criticism even as Powell cut rates in 2019.

Biden’s endorsement of the Fed’s policies – a position echoed by Republican leaders in Congress – gives Powell important political cover for a series of sharp interest rate hikes aimed at reining in high prices. However, higher rates can lead to layoffs, raise the unemployment rate and even push the economy into recession.

Amid fears that the US economy may repeat the persistently high inflation of the 1970s, cooperation between Biden and Powell represents a crucial difference from that time and could make it easier for the Federal Reserve to rein in higher prices. In the early 1970s, President Richard Nixon pressured Federal Reserve Chairman Arthur Burns to cut interest rates to stimulate the economy before Nixon’s re-election campaign in 1972. Nixon’s intervention is now widely seen as a major contributor to hyperinflation, which remained high until the early 1980s. .

“This is why comparisons with the 1970s are wrong,” said Sebastian Mallaby, a senior fellow at the Council on Foreign Relations and author of a biography of former Federal Reserve Chairman Alan Greenspan, “The Man Who Knew.” The president’s article was remarkable because it explicitly supported the Federal Reserve. “

Biden faces a growing global challenge Energy and food costs soared after Russian President Vladimir Putin ordered an invasion of Ukraine in February. At the same time, China imposed lockdowns linked to the coronavirus outbreak that further strained supply chains. That left record nursing inflation in the European Union and the risks of a recession, while American consumers are increasingly resentful of gas prices, which averaged a nominal record $4.62 a gallon.

Powell pledged to keep raising the Fed’s short-term interest rate to cool the economy until inflation drops in a clear and convincing way. But these rate increases have raised concerns that the Fed, in its quest to slow borrowing and spending, could push the economy into recession. This concern has caused sharp declines in stock prices in the past two months, despite the markets rebounding last week.

Biden, in his op-ed, indicated that the record pace of job creation in the wake of the pandemic will slow significantly, indicating more moderate levels of 150,000 jobs per month than 500,000. He said this would not be a warning of weakness but “a sign that we are successfully moving into the next stage of the recovery – where this kind of job growth corresponds to a low unemployment rate and a healthy economy”.

“Extreme travel lover. Bacon fanatic. Troublemaker. Introvert. Passionate music fanatic.”

More Stories

Best National Burger Day Deals 2024

Trump attacks Fed for ‘playing politics’ with historic rate cut

Tesla “Magnificent Seven” (TSLA) shares report third-quarter earnings this week. Is it a buy before the results?